“And when things start to happen, don’t worry don’t stew, just go right along, you’ll start happening too.”

— Dr. Seuss, “Oh, The Places You’ll Go”

S&P 500 Throws Investors a Curve Ball

Just when many began to feel that the market may have bottomed on June 16 and that that day may have marked the beginning of a new bull market, investors were thrown a curve ball in late August. The S&P 500 had rallied off that 3,666 low and surged back to the 4,300 level by August 15. Leadership had shifted significantly in a positive way from the more defensive and winning areas of the market during the stock market swoon from January 3 through the middle of June—sectors such as utilities, staples and energy—to the more risk-on groups like consumer discretionary and technology.

The S&P 500 had risen back above its 50-day moving average and was close to breaking back above the 200-day moving average. Indeed, these are signals that tend to flash around market bottoms based on history. This positive karma came to a rather screeching halt, though, in the final two weeks of August. While improving inflation data, evidence of progress on the supply chain front, solid second-quarter earnings releases and continued strong employment reports all contributed to the rally, it appears that a big part of the equation may have been investors’ premature speculation that the Federal Reserve is virtually done raising rates and might even be contemplating rate cuts by mid-2023.

We applaud the former healthy fundamental trends and believe that this is what will ultimately drive the market to higher highs in 2023. However, we agree with those who are concerned on this latter point—that investors had become too hopeful, too soon that the Fed was ready to bank a win in its inflation battle and declare “game over” on that front. This is misguided investor sentiment, in our view. Ironically, the retrenchment in stock prices in the final weeks of August culminated on Friday, August 26, after Fed Chair Jerome Powell provided updated thoughts in an afternoon presser regarding monetary policy the Fed is pursuing to squelch inflation. His comments were interpreted as more hawkish than anticipated and resulted in the roughly 3.4% sell-off that day after his statements hit the news wire.1 The softness continued in the early days of September and has brought the S&P 500 back below the 4,000 level… above the June low but below the 4,300 high mark in the recent rally.2

Rising Fed Funds Rate Is Good News

While we believe it is premature to state that June 16 was indeed a bottom and a new bull chapter has begun, we do think we are closer to a bottom than a top and that the most likely downside is back to the June 16 low of 3,700-ish, give or take. We say this because we think the news on August 26 from Powell and the Fed was much ado about nothing. In fact, we are thrilled the Fed is saying they want to remain vigilant in fighting inflation and suggest that investors were misguided if they were anticipating definitive rate cuts beginning mid-2023, which were built into the fed funds futures rate curve at the time.

After the market digested Powell’s August 26 press conference following the Fed’s recent Jackson Hole symposium, this curve now calls for fed funds rates to rise to 3.5% early next year and end up at a peak of 3.7% by December 2023.3 We look at this as good news… the market expects rates to continue to rise, but only modestly and in keeping with Chief Economist Bill Greiner’s forecasts as well.

Federal Reserve Disciplined on Fighting Inflation

The big mistake the Fed made in the 1980s was pivoting and cutting too fast. They won’t make that mistake this time… but neither are they pursuing a scorched earth policy. All the Fed is actually saying is that they will be disciplined in fighting inflation until they see evidence it is calming and at that point will stand and pause. While they are likely to hike again a few times this year, they are unwilling to say whether it will be by 50 or 75 basis points at the next meeting. They want to see the next set of CPI and employment metrics first. In other words, they will be data dependent. The chairman used the word “data” 16 times in his media dialogue—we applaud fact-based decision-making! This makes total sense to us, and you couldn’t ask for a more prudent stance from the Fed at this juncture, in our view. They may have been slow to begin raising rates, however, their measured but vigilant stance seems spot-on in this environment. This Fed chair has demonstrated an ability to “pivot” and make mid-game adjustments on more than one occasion during his tenure as required by new data. Good stuff.

Updated Outlook

Bottom line, our longer-term view of the market has not changed… we are looking for a base case of 4,500 on the S&P 500 in the next 12-15 months and perhaps an optimistic upside of 5,000. The former is based on inflation calming a bit but still remaining elevated, the fed funds rate peaking in the 4% range (which is exactly Bill Greiner’s outlook), consensus earnings of $240-$245 per share and an associated price-to-earnings ratio of somewhere between 18 and 19 times. This is no different from what we were saying one or two months ago even when the market was hitting new lows. We expressed back then that for the market to catch an edge and for stock prices to begin rising again, inflation would need to either begin calming or at least be “less worse,” and that the market would need to sense the Fed would not be forced to pursue uber-restrictive policy, which could cause a severe recession like that of 2007-2008.

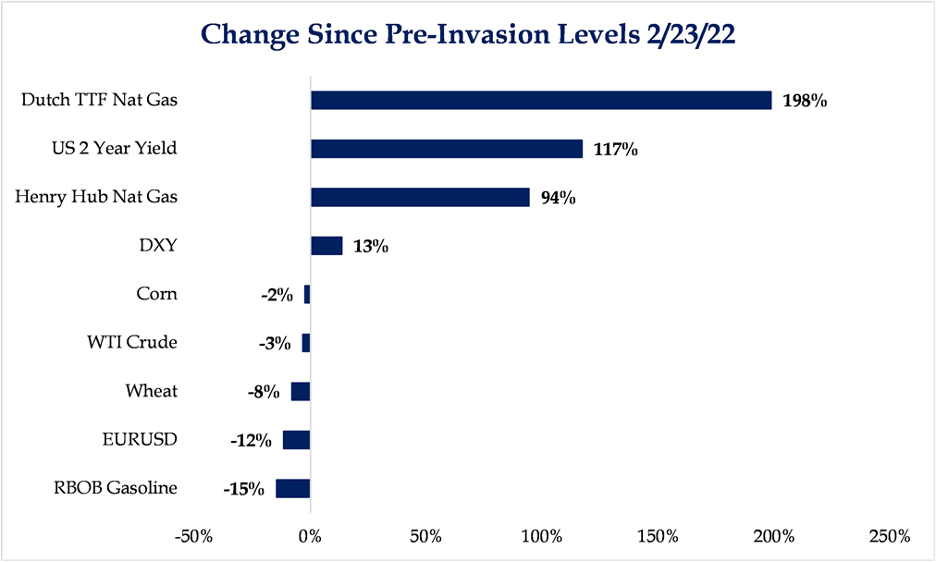

Regarding the former point, the incremental inflation information we have received since my commentary last month has trended in a positive direction. Headline and core CPI eased a bit, gas prices have fallen from $5 to $3.80-$3.90 per gallon4 and delivery times and order books have softened, suggesting supply shocks are easing. The chart demonstrates that all commodity prices, excluding natural gas, have fallen back to pre-Ukranian war levels.

Source: Strategas as of 8/30/22

This implies that we should see further improvement in the next consumer price index data when it is released on September 13. Things do look to be not worsening on the inflation front.

In terms of incremental fundamental economic data, while mixed it also skews toward the positive. The manufacturing activity data as captured in the August Institute of Supply Management Purchasing Manager’s Survey (one of three key recession indicators we follow) held steady at 52.8 and in growth mode. August consumer confidence ticked up, probably based on declining gas prices and solid employment trends.5

Our positive longer-term view is based on this mosaic of better inflation data, continued solid fundamentals and a serious yet composed and information-based Federal Reserve.

Inflation Is the Key, Not Recession—Still in “Hold Your Ground” Mode

On the August month-end advisor call in which Bill Greiner and I presented our thoughts to wealth advisers throughout the firm, we both agreed that the risk of a mild recession has largely been discounted in the price level of the S&P 500. If one examines mild recessions, the stock market falls approximately 25% during these periods, which was almost exactly how much the market fell from January 3 to June 16 in anticipation of such an event. In fact, most of the damage to stock prices generally occurs in advance of the recession. Once one is declared, and we know we are indeed in recession, the market actually has risen from that point through recession-end almost 50% of the time.6

Oddly, most economists label this particular environment a “growth recession,” meaning that they expect GDP growth will be slower in 2022 and 2023 but not negative. Key economists and economic forecasters such as Ed Yardeni, Strategas and the Atlanta Federal Reserve are calling for real GDP growth of 1% or more in the second half of 2022. The first and second quarters of the year may be revised up from previously released estimates as well. It’s just odd to see true recession when employment levels and consumer spending are as solid as they are at present. Unlike the summary data describing earnings trends in previous recessions where earnings fall 30% or more on average, they very well may stay positive in this growth slowdown.7 Regardless, using history as a guide, the point is that a normal, mild recession and an associated earnings decline already seem to have been discounted into stock prices.

To us, the real key here is how sticky inflation is and how high the Fed has to drive rates, not whether we will have a mild recession. It appears inflation is getting less worse and that the Fed will be able to raise rates a bit more and then pause at levels below worst-case fears. We need more evidence that inflation is calming and that indeed this will enable the Fed to avoid uber-restrictive policy before we feel comfortable waving the all-clear signal. Therefore, we maintain our “hold your ground” recommendation rather than suggest employing a high-conviction, “buy on the dips” message.

What to Do?

While we firmly expect to see higher stock prices over the next 12 months, we anticipate some choppiness for a couple of months as we continue to work through these policy and inflation transitions. We also believe active management in portfolio strategies is positioned to outperform a purely passive approach. We see opportunities to begin upgrading/rebuilding positions and putting money to work in specific stocks that have been unduly punished while maintaining your overall normal equity allocation.

In the most recent internal monthly investment call with wealth advisors, I suggested that if you are a normal investor, you should hold your ground at your normal allocation. If you are very aggressive and are below your normal allocation, you may want to begin adding to your equity holdings. If you were greedy early in 2022 and went into the year above your normal allocation and find you are faint of heart, you may want to reduce your equities given this recent rally… point being, know who you are.

Wrap Up

Instinctively, I channeled Dr. Seuss’ “Oh the Places You’ll Go” in reflecting on the 2022 stock market environment. Just about the time investors think they have figured out the inflation puzzle or the direction of the Fed and that smooth sailing is with us again, curve balls are launched. Welcome to the stock market. As Dr. Seuss advises, when “bang ups and hang ups” happen to us, we shouldn’t stew. His conclusion about keeping our composure applies to both life and finances: “So be sure when you step, step with care and great tact and remember that life’s a great balancing act.”

Fed “pivots” and a steady flow of data are constantly thrown at us. The key in these moments is to stay grounded. Regarding the financial markets, that means to maintain focus on the facts.

At this juncture, the key metrics are good enough for you to be invested at your normal stock allocation given our belief that stock prices will be higher over the next 12-15 months. They are uncertain enough to resist moving allocations to more bullish and confident levels, respecting that psychology in the market could cause it to test previous lows.

Balance is the key during this transitional period. We are with you all the way trying to combine our investment research with your goals and preferences to provide you with our very best guidance in the midst of what happens along the way to long-term success. Stay tuned.

Sources:

1FactSet

2LPL

3-7FactSet

Disclosures:

The S&P 500 Index is a market-value weighted index provided by Standard & Poor’s and is comprised of 500 companies chosen for market size and industry group representation. The index is unmanaged and cannot be directly into. Past performance does not guarantee future results. Investing involves risk and the potential to lose principal.

This commentary is limited to the dissemination of general information pertaining to Mariner Platform Solutions investment advisory services and general economic market conditions. The views expressed are for commentary purposes only and do not take into account any individual personal, financial, or tax considerations. As such, the information contained herein is not intended to be personal legal, investment or tax advice or a solicitation to buy or sell any security or engage in a particular investment strategy. Nothing herein should be relied upon as such, and there is no guarantee that any claims made will come to pass. Any opinions and forecasts contained herein are based on information and sources of information deemed to be reliable, but Mariner Platform Solutions does not warrant the accuracy of the information that this opinion and forecast is based upon. You should note that the materials are provided “as is” without any express or implied warranties. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Consult your financial professional before making any investment decision.

Investment advisory services are provided through Mariner Platform Solutions, LLC (“MPS”). MPS is an investment adviser registered with the SEC, headquartered in Overland Park, Kansas. Registration of an investment advisor does not imply a certain level of skill or training. MPS is in compliance with the current notice filing requirements imposed upon registered investment advisers by those states in which MPS transacts business and maintains clients. MPS is either notice filed or qualifies for an exemption or exclusion from notice filing requirements in those states. Any subsequent, direct communication by MPS with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For additional information about MPS, including fees and services, please contact MPS or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you invest or send money.

Investment Adviser Representatives (“IARs”) are independent contractors of MPS and generally maintain or affiliate with a separate business entity through which they market their services. The separate business entity is not owned, controlled by, or affiliated with MPS and is not registered with the SEC. Please refer to the disclosure statement of MPS for additional information.