The U.S. stock market broke out of the gate in style and good fashion in this new year. It provided a nice breather from the negativity we all felt throughout 2022. The S&P 500 advanced over 6% in January, which marked the best January for this index since 2019.1 But it feels like there could be much more to it than this fact when you look below the surface. Investors showed some “risk-on” attitude for the first time in quite a bit.

Small-cap stocks, represented by the Russell 2000, rose almost 10%, while the tech-laden Nasdaq rallied more than 10% in 2023’s first month.2 International stocks did even better than the U.S. markets and were buoyed by a European economy that is weathering the shocks emanating from the Ukrainian-Russian war better than feared as well as by a Chinese economy that looks to have bottomed and that is benefiting so far this year from reopening and less austere COVID-19 policies. A weaker dollar also helped the return figures in these foreign markets.

Leadership within the S&P 500 also demonstrated the willingness of investors to take on more risk. To wit, it is the losers of 2022 that are leading early on in 2023. The defensive sectors, such as staples and utilities that exhibited strength last year, are rolling over in terms of relative performance and surrendering leadership to the cyclical and more aggressive sectors of the market, such as information technology, materials and industrials.3 The very cyclical consumer discretionary sector, which includes retailers, auto manufacturers and suppliers as well as leisure companies, was challenged in 2022 but has launched quite nicely in 2023.

Where Is the Market Headed?

What does this all mean? Where do we think the market is headed for the rest of the year and what strategies should one employ in this stage of the economy and financial markets? Has the market bottomed and will there be smooth sailing ahead? We do think we are headed higher as the year evolves but caution and patience will still be virtues in the first half of the year, in our opinion. A few might suggest we’re at the “all clear” stage. Data connoisseurs/junkies will highlight that the U.S. stock market is positive for the full year over 70% of the time when January returns are positive. Some will talk about the “Super Bowl” effect… the observation that the stock market does well when an NFC team wins the Super Bowl. While the first linkage above holds some credence, there’s not a lot of cause-effect going on there, and certainly you wouldn’t hold much respect for us if we suggested that if the Eagles win the Super Bowl, we would turn even more positive on our market outlook for 2023.

Our View on Stocks

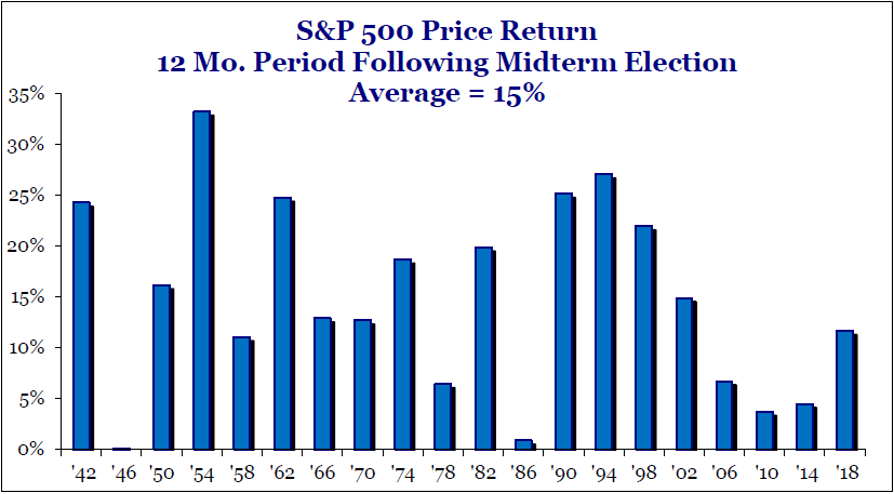

There are a couple of seasonality factors, however, which are more cause-effect in nature that support our constructive view on stocks this year. Regarding politics and associated policy influences, one clear pattern emerges. Historically, the U.S. stock market has generated handsome double-digit returns in the 12 months following midterm elections based on data going back more than 60 years. Importantly, the market has never generated negative returns in this 12-month period. This year could be the first time, of course, but it would be bucking a significant historical force and trend. The rationale supporting this is simple. Washington policy is far more active in the first two years of a presidential cycle than in the final two, because leaders want to employ their agenda and policies as early as they can in their new term, which might not be well embraced by the broad electorate. The “spinach,” so to speak, is distributed in those first two years so that they can get that out of the way and start handing out sugar and candy in the final two years of their term as the presidential election approaches in year four. In response to this more active fiscal policy, the Federal Reserve is generally more active on the monetary policy front in the first couple of years of a new presidential term to either “fix” or to adjust to economic effects resulting from these Washington policy initiatives. The point is that both Washington and Fed policy tends to die down in years three and four of the cycle. Investors’ fear of policy risk subsides at such time, which allows them to focus on the underlying trends in the fundamentals of the economy and financial markets. Generally, these are fairly good in the U.S., so the U.S. stock market tends to rally in the more policy-quiet “year three” moment such as 2023.

Source: Strategas

In that vein, we think the fundamental, valuation and technical backdrop of the market is neutral to positive, not negative as the headlines suggest. You know this quite well from our various writings. Yes, fundamentals are mixed as we have pockets, such as housing and demand for electronic gadgets, that are softening, but we have others that are solid. For example, demand for services is quite strong as reflected in traffic at bars, restaurants, airlines and hotels. Sales of business equipment remains brisk.

Full Employment Levels

We are at full-employment levels as reflected in the 3.5% unemployment rate, and initial unemployment claims are at historic lows.4 You may read about layoff announcements at large tech companies, such as Salesforce and Microsoft, but these companies over hired in the pandemic era (of cocooning and buying gadgets for remote activities) and are doing the productive thing in rightsizing at this point following a sustained reopening of our economy. Such layoffs at these large companies are swamped by the strong continued hiring binge at smaller companies. According to The Wall Street Journal, small companies have hired more than 3.5 million workers in this post-pandemic period, while large companies have let go roughly 800,000.5 So, net-net, payrolls continue to grow handsomely. U.S. consumers are employed, and they are spending, just on different stuff now (services) versus gadgets during the pandemic.

Valuation has become more attractive and reasonable with the S&P 500 priced at 18 times forward earnings versus 22 times at the end of 2021.6 Technical price trends have improved with a broadening list of stocks participating in positive returns versus the concentrated nature with only a handful driving the market in earlier periods. These are all good signs of improving health. They are signs that the market seems to be telling us it wants to bottom and move higher on a more sustainable basis versus the early failures to break the downtrend on a more permanent basis back in June and October of last year.

We’ll have to stay tuned on this front. We remain cautious regarding a sustained breakout until other investors than just us and a handful of members of the Fed board become convinced that inflation is truly calming. It is calming and significantly so. The headlines say 5% to 6%, but if you comb the data, it jumps off the page to us that inflation is running more like 3% if you take the last three months of inflation figures and annualize them. Growth in the money supply, which ultimately drives inflation, is falling rapidly. So, if history is any guide, inflation will also fall in lagged fashion. Once a broader list of investors recognizes this (as well as Jerome Powell), the market should break out to the upside.

Hence our target of 4,500 or better for the S&P 500.

Technically Speaking

A question we get frequently is, “Has the market bottomed and put in the low?” Our answer is that there are major signs that perhaps it has. Some of these signs were there back in June and October of 2022 as well, but the market rolled over both times when Fed Chair Jerome Powell somehow morphed into a Paul Volcker clone and started talking very tough/hawkish on inflation and squashed the rallies. He may still talk tough for a little bit longer, but he has good reason to soften tone now that he has hiked rates almost 5% since then, the economy has softened a touch and inflation has improved rather dramatically. Should it continue to trend in better fashion, this Fed chair can finally pause both on the tough rhetoric and on the rate increases and that should help inspire the encouraging risk-on price trends we see so far this year.

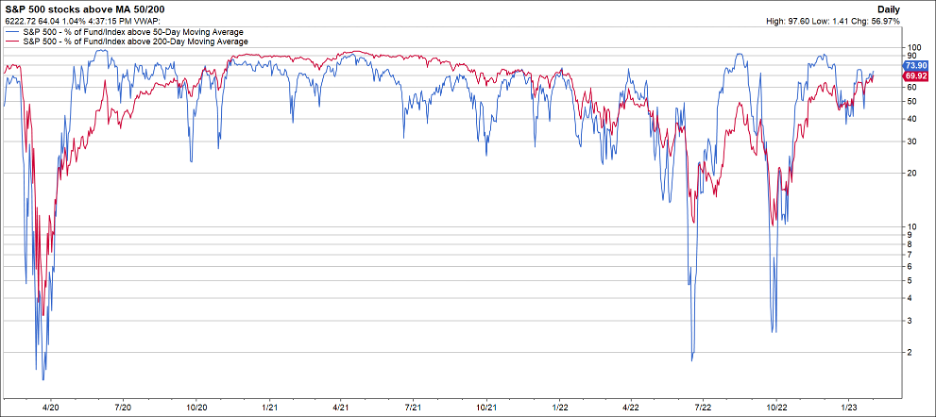

As the price trend chart below on the S&P 500 shows below, we are at a potential crossroads. The S&P 500 has rallied more than 11% off the October bottom and had a nice 6% price move to the upside in January to start the year. It is just now coming into heavy resistance at the 4,100 level. If it can break above this, it suggests there is confidence to go higher. We’ve seen a considerable period of lower highs and lower lows in the S&P 500, and this would put a nice, productive dent in breaking that pattern.

Source: FactSet

Unlike these past rallies that failed, the strength in the market is broader this time as reflected in the greater number of stocks trading above their 200-day moving average (65%) and an improving number of stocks advancing versus declining. The equal-weighted S&P 500 is well outperforming the more concentrated cap-weighted S&P 500. It’s not a small list of “FANG” stocks that are driving the market as in yesteryear. The average stock is outperforming the index, so this is a healthy sign that this could have legs.

Source: FactSet

Source: FactSet

Wrap-Up/Conclusion

That said, we are quite sober about the very near-term prospects for rapid gains in the S&P 500 and believe the all clear signal to increase stock exposure and decisively “buy on the dips” mentality should be deferred until later in the year after we see a couple more CPI and payroll reports and a couple more Fed press releases. We also are going to have to read about and watch debt ceiling debate coverage for a bit in 2023’s first half. The debt ceiling should be raised, and all resolved adequately on this front, but it’s just no fun to watch all the insults and threats in Washington. Investors might get crabby and depressed a bit before they realize it’s the same old, same old gridlock, and it’s the fundamental trends that drive the market with the market looking at where the puck is going not at where it is today.

We have counseled investors to hover at their long-term targeted equity allocation. If you are a 60% stock investor in a 60-40 stock-bond framework, stay there. Don’t buy more, but don’t sell down in the midst of these negative headlines about inflation, recession and upcoming debt ceiling debates.

Again, we anticipate that 2023 will be the inverse of 2022. 2022 was a year of continued economic expansion and earnings growth, yet a horrible stock market. 2023 is likely to be a year when we finally get the slowdown in the economy and earnings, yet we have a healthy stock market. In its anticipatory nature, the market already declined in 2022, as it sensed a slowdown in 2023. Similarly, the market should recognize the slowdown is not as bad as feared and anticipate the recovery as we move through the year and on into 2024 and rise in advance.

As always, we’ll continue to monitor all on your behalf and report back to you next month as things evolve on any signs of progress.

Footnotes

1-4FactSet

5“How the Fed’s Fight Against Inflation Could Hit Small Business,” Wall Street Journal video

6FactSet

Definitions

The S&P 500 Index is a market-value weighted index provided by Standard & Poor’s and is comprised of 500 companies chosen for market size and industry group representation.

The Russell 2000 Index measures the performance of the 2,000 smaller companies included in the Russell 3000 Index. The Nasdaq Composite Index measures the performance of more than 3,000 securities that are listed on the Nasdaq stock market.

Disclosures

Indexes are unmanaged and cannot be directly invested into. Past performance is no indication of future results. Investing involves risk and the potential to lose principal.

This commentary is limited to the dissemination of general information pertaining to Mariner Platform Solutions investment advisory services and general economic market conditions. The views expressed are for commentary purposes only and do not take into account any individual personal, financial, or tax considerations. As such, the information contained herein is not intended to be personal legal, investment, or tax advice or a solicitation to buy or sell any security or engage in a particular investment strategy. Nothing herein should be relied upon as such, and there is no guarantee that any claims made will come to pass. Any opinions and forecasts contained herein are based on the information and sources of information deemed to be reliable, but Mariner Platform Solutions does not warrant the accuracy of the information that any opinion or forecast is based upon. You should note that the materials are provided “as is” without any express or implied warranties. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Consult your financial professional before making any investment decision.

Investment advisory services are provided through Mariner Platform Solutions, LLC (“MPS”). MPS is an investment adviser registered with the SEC, headquartered in Overland Park, Kansas. Registration of an investment advisor does not imply a certain level of skill or training. MPS is in compliance with the current notice filing requirements imposed upon registered investment advisers by those states in which MPS transacts business and maintains clients. MPS is either notice filed or qualifies for an exemption or exclusion from notice filing requirements in those states. Any subsequent, direct communication by MPS with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For additional information about MPS, including fees and services, please contact MPS or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you invest or send money.

Investment Adviser Representatives (“IARs”) are independent contractors of MPS and generally maintain or affiliate with a separate business entity through which they market their services. The separate business entity is not owned, controlled by, or affiliated with MPS and is not registered with the SEC. Please refer to the disclosure statement of MPS for additional information.