“You got to let me know…should I stay or should I go?” – Lyrics from the 1980’s hit song from The Clash

The S&P 500 finished the year in strong fashion, posting another record close at the end of December. This marked its 70th new high during the year and resulted in a nearly 27% price gain for calendar year 2021.1 Returns have been robust over the longer trailing three-year period as well. Specifically, 2021 was the third consecutive year of double-digit returns for large cap U.S. stocks, which generated over 26% compounded annualized returns for investors over this three-year period.2

We should all appreciate the fact that this doesn’t happen very often. Further, four consecutive years of double-digit returns has only happened twice in modern times…in the midst of the late 1990s tech run, and, ironically during the 1940s long-awaited economic recovery from the Great Depression that ultimately occurred due to our country’s efforts to mobilize for World War II. So, it would be quite rare to see another year of such impressive gains in 2022, simply based on the historical data.

In mid-January, we will hold our annual our Crystal Ball Outlook webinar where I’ll go into more detail about what we see ahead for the U.S. equity market. Our much-abridged executive summary at this juncture is that, while we remain positive and believe the market to post further gains in calendar 2022, unlike the past two years in which we anticipated strong double-digit returns for the S&P 500, we believe results may be a bit more sobering next year. With current price to earnings (P/E) levels hovering at 22 times earnings, additional multiple expansion is unlikely, in our view, and gains are more likely to be tethered to projected earnings growth in the 8% to 10% range. Not too shabby but certainly not as robust an environment as we’ve seen in 2020 and 2021.

Further, we wouldn’t be surprised to see a sizable correction sometime next year, prior to moving to higher highs. This is based on multiple factors. First, it would be quite normal on the heels of the roughly 100% cumulative returns we have seen in the S&P 500 over the last three years and the fact that we haven’t seen more than a 6% pullback in over a year.

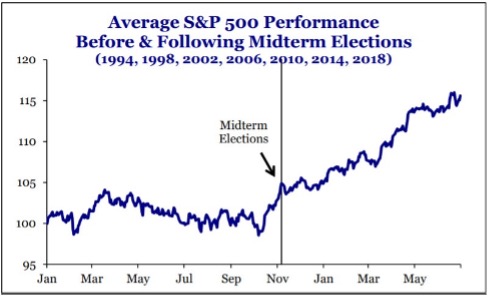

In addition, risk levels are rising in a transitional environment of accelerating inflation and shifts in Federal Reserve policy. Despite the fact that we think these are manageable risks that do not threaten a positive outcome for calendar 2022, they will foster headline concerns and intra-year moments of investor angst. We can’t forget that 2022 is a midterm election year that generally results in flat-to-negative returns through the election followed by a relief rally at year-end. Temporary drawdowns also are higher than average in these election years. In other words, investors might do themselves a favor by having lower expectations in the early quarters of 2022.

Source: Strategas The data reflects the average performance over the course of 18-months starting in January of the seven years listed during which a midterm election took place in November.

What Should Equity Investors Do?

Given our constructive but more modest expectations for stock market returns in 2022, what should an investor do as we begin the new year from our perspective? To borrow from well-known economist Ed Yardeni’s work and his sense of humor and associated appreciation for 1980s/1990s rock music, we turn to lyrics from the band, The Clash, which he cites in one of his recent writings… investors must be asking: “Should I stay or should I go?” That is, should they hold fast or should they retreat from U.S. equities at this juncture?

It may sound very unexciting, but based on our points above, our recommendation is to do nothing right now. As billionaire investor Larry Tisch once said…when there is nothing to do, do nothing. Stocks remain attractive based on the positive fundamentals, reasonable valuation and still supportive technical price trends.

On the fundamental front, the U.S. consumer is in as strong of a position as ever and willing to spend. The 8.5% advance in retail sales during the 2021 Christmas holiday season is a clear indicator of the latter.3 The employment data continues to be solid on all fronts, with unemployment claims at decades lows and average monthly payroll gains of over 550,000 per month in 2021 through the end of November.4

Manufacturing and service level activity remain at close to all-time highs based on the Institute of Supply Management surveys. Trends in U.S. company earnings and profit margin data continue to impress and surprise positively. Certainly, they will slow from the V-shaped recovery levels we saw in 2020/2021, but they should slow only to still healthy levels. On the valuation front, bearish investors cite the elevated S&P 500 P/E ratio of 22 times earnings.

While that is true, we note the fact that the eight largest stocks in the S&P 500 unduly influence this with their average P/E of more than 30 times; the other 490 or so stocks trade at a reasonable P/E of 18 times, so there are plenty of reasonably priced stocks to purchase.

In addition, stocks still look attractively priced overall in this low interest rate environment with dividend yields roughly equivalent to the 10-year Treasury yield. Finally, the technical backdrop of the market is solid with most stocks still in long-term uptrends, and sentiment is far from bullish. The latter suggests there are plenty of skeptics out there on the sidelines to come into the market and support it at moments of pullback or correction.

One key thing we want to stress is that our clients should consider rebalancing back to your normal long-term strategic allocation in stocks if your equity exposure has drifted to higher levels during this recent period of excessive returns. If you do this, it should provide the courage to step in and buy stocks if we do get a meaningful temporary pullback and take advantage of attractive entry points. It also helps to guard against panicking and yielding to an urge to sell stocks in the midst of a downdraft because you allowed your stock holdings to become too large of a component of your portfolio during the good times.

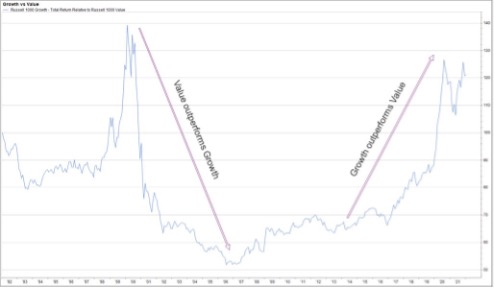

In addition, we also stress staying balanced in positioning of stock portfolios. We continue to encourage folks to maintain a balance of both growth and value in portfolios and certainly this has been important in 2021 as leadership has seen roller coaster shifts in these two camps throughout the year. We think such balance will also be important in 2022.

Source: Factset

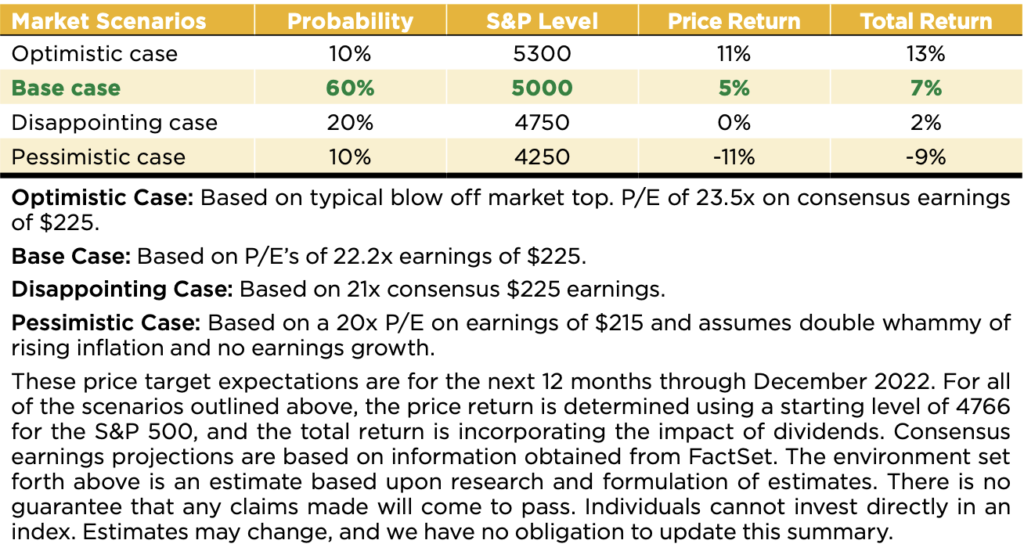

Crystal Ball Teaser—Base Case

As part of our normal annual research/analytical process, we have developed four different scenarios to describe possible outcomes for 2022 that we believe have a 10% or greater probability of occurring. We assign a 70% probability of positive returns next year with our base case calling for mid- to high single-digit returns of 5%-7%. We assign a 60% probability to our base case in which we project that the S&P 500 could advance from its current level of 4766 up to 5000 or above. We do think there is a slight 10% chance that returns could again fall in the double-digit category as you can see in our optimistic scenario, which envisions an S&P 500 level of as high as roughly 5300 by the end of 2022. The environment we think supports such positive results is one that assumes:

- 3% real GDP growth for the year

- Federal Reserve hikes interest rates several times during the year, yet still remains accommodative on a relative historical basis

- A 10-year Treasury yield that falls in a range of 1.25% to 2.5%

- Earnings growth of 8%-10%.

In our base case, we expect multiples to hold at their current level of roughly 22 times earnings; in the optimistic case, we consider that multiples could expand to the 23-24 times level, should inflation indeed prove to be more benign than feared.

In the disappointing case, in which the S&P price level simply sits at current levels the entire year, we envision the possibility that inflation lingers longer than we expect, which may cause multiples to contract slightly. In the pessimistic case, we appreciate that the market could decline by 10% or so in calendar 2022, should we experience a “stagflation-lite” economy—in other words, one characterized by both lingering higher levels of inflation and slower real economic growth than the 3% figure we assume.

There is one other more nuanced thought that we think is important to express. Despite our base case outlook of solid, single-digit returns for the S&P 500, we could see a meaningful correction sometime during 2022. That said, we caution investors from acting to guard against such a temporary event, because it should be very short-lived based on the continued solid underlying data that is being reported at present…and that we expect to hold in the coming months. Headlines about potential risks cause corrections. True underlying facts and data drive the markets longer term. Acting prematurely on emotional, headline-oriented factors can cause investors to suffer from whiplash and wealth destruction.

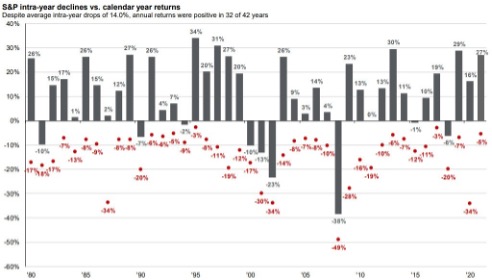

The sharp but brief 30%+ correction in March 2020 is a great example, as the market quickly recovered and advanced more than 90% from that low through the balance of that year and resulted in a 16% price return for the 2020 calendar-year period. The chart below shows that, historically, there have been a number of years in which the S&P 500 experienced sharp and brief intra-year corrections yet ultimately ended up in handsomely positive territory in those calendar years.

Source: FactSet, Standard & Poor’s, J.P. Morgan Asset Management. Returns are based on price index only and do not include dividends. Intra-year drops refers to the largest market drops from a peak to a trough during the year. For illustrative purposes only. Returns shown are calendar year returns from 1980 to 2018, over which time period the average annual return was 8.4%. Guide to the Markets – U.S. Data are as of December 31, 2021.

What would get us to change our positive view?

Rising rates and inflation. We happen to be in the camp that looks for inflation to peak sometime in 2022, and slow to more moderate levels by the end of next year. We caution investors from getting too optimistic or too pessimistic on the inflation front and wait to see how this data evolves. We continue to look for signs of a peak in inflationary pressures and do see some embryonic signs of this. These include guidance from management of semi-conductor companies that bottlenecks are easing, and from data that shipping rates in the transportation industry are calming from huge spikes earlier in 2021. We are monitoring these trends closely.

We also take comfort in the fact that, at present, bond investors do not see sustained levels of high inflation. Yes, the Fed will be shifting to a slightly less accommodative stance in 2022 and is likely to raise rates several times this year—its signals are quite clear on this front. Our take on this is: isn’t it about time? The Fed funds rate has been at abnormally low levels for some time. The Fed is merely talking about moving toward normal. Historically stock market returns are quite satisfactory in a normal economic and earnings growth environment.

All this said, our current assessment that the S&P 500 is reasonably valued is largely based on low levels in interest rates coupled with steady growth in earnings. Should inflation turn out to be a larger and more permanent problem than we anticipate, it could cause the Fed to take more aggressive action than what they have signaled so far. If that happens, it could drive rates to rise significantly higher than our base case expectations, and stock valuations would become stretched. In such a case, we would adjust our view and message to investors accordingly.

Wrap-up

We’ll use a football analogy to wrap up for those who didn’t get enough of it on New Year’s Day. 2022 may be more like a “three-yards and a cloud-of-dust season.” We’ll see victory, but it won’t be a blowout experience like that of the three past years. Stay confident about the success of the team but anticipate the win to come toward the end of the game, with some drama in between, and the margin of victory to be narrower than in years past.

Thanks for your confidence in us and wishing all a prosperous and healthy 2022!!

Sources:

1 Factset data

2 Factset data

3 Mastercard.com

4 Factset data

The S&P 500 Index is a market-value weighted index provided by Standard & Poor’s and is comprised of 500 companies chosen for market size and industry group representation.

This commentary is limited to the dissemination of general information pertaining to Mariner Platform Solutions’ investment advisory services and general economic market conditions. The views expressed are for commentary purposes only and do not take into account any individual personal, financial, or tax considerations. As such, the information contained herein is not intended to be personal legal, investment or tax advice or a solicitation to buy or sell any security or engage in a particular investment strategy. Nothing herein should be relied upon as such, and there is no guarantee that any claims made will come to pass. Any opinions and forecasts contained herein are based on information and sources of information deemed to be reliable, but Mariner Platform Solutions does not warrant the accuracy of the information that this opinion and forecast is based upon. You should note that the materials are provided “as is” without any express or implied warranties. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Past performance does not guarantee future results. Consult your financial professional before making any investment decision.

Investment advisory services provided through Mariner Platform Solutions, LLC (“MPS”). MPS is an investment adviser registered with the SEC, headquartered in Overland Park, Kansas. Registration of an investment advisor does not imply a certain level of skill or training. MPS is in compliance with the current notice filing requirements imposed upon registered investment advisers by those states in which MPS transacts business and maintains clients. MPS is either notice filed or qualifies for an exemption or exclusion from notice filing requirements in those states. Any subsequent, direct communication by MPS with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For additional information about MPS, including fees and services, please contact MPS or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you invest or send money.

Investment Adviser Representatives (“IARs”) are independent contractors of MPS and generally maintain or affiliate with a separate business entity through which they market their services. The separate business entity is not owned, controlled by or affiliated with MPS and is not registered with the SEC. Please refer to the disclosure statement of MPS for additional information.