“Profits should be based not on optimism but on arithmetic.” – Ben Graham

Equity returns have been spectacular in 2021, with the S&P 500 up over 23% through November.1 The index has established 65 new highs so far this year; the second most new highs recorded in a single year, ever.2 Similar to the market’s resilience displayed during the peak of the pandemic scare in 2020, the market has continued to climb that wall of worry that has only seemed to grow taller as we moved through 2021. Inflation, supply chain bottlenecks, labor shortages and fear of potential new strains of coronavirus stand at the top of the list of concerns on investors’ minds, as well as fear of policy mistakes to address these issues.

How has the market continued to advance in the face of these risks? The answer is grounded in the data and still solid underpinnings of the economy and market. The employment picture continues to improve as the reopening process evolves, and consumer balance sheets are as healthy as they’ve ever been. A plethora of economic releases Thanksgiving week suggest that the U.S. economy is reaccelerating as we head to the end of the calendar year. Household spending rose 1.3% in the month of October from the prior month,3 and holiday spending is expected to be up 8.5% to 10.5% versus half that pace last year.4 True, a good portion of that is associated with price increases, but the U.S. consumer appears quite willing to spend given solid income growth and accumulated savings.

Initial claims for unemployment are at 52-year lows,5 illustrating that folks are getting back to work. The surveys for activity in the manufacturing and services sector of the economy continue to pace at historically high levels. The Q3 earnings season has been very positive, with more than 80% of companies beating expectations and posting upwardly revised earnings growth of more than 40%.6 Interest rates remain low and credit spreads tight. Based upon these positive metrics, we believe the market can continue to advance over the intermediate to longer term and maintain an upside target of 5,000 for the S&P 500 in 2022.

Inflation Update…Is it Transitory or Not?

This is the question of the day, and it is a tough one! Quite frankly it is unclear at present, but, in our mind, there is no reason to jump to conclusions. The Federal Reserve has shifted its language to say inflation is more “persistent” than previously thought but it has been clear that it still believes this is associated with one-time bottlenecks resulting from the pandemic. While lingering for longer than hoped, inflation will calm as these temporary issues abate. In our view, we are still in the early innings, and there is no pressure to predict. We’ll follow the data. When investors think about inflation today, it seems like they reflexively envision the hyperinflation/stagflation of the 1970s and early 80s. We view it as more like the 1950s when inflation just began to accelerate in a post-war world. At that point, it was at a more benign stage…it took over 20 years to transform into an ugly wage price spiral.

Further, with an accelerating U.S. economy as we move into Q4, stagflation doesn’t appear to us to be a high probability scenario in 2022. We recognize that inflation will run hotter longer than originally expected, but, like the Fed, do look for it to moderate in 2022, as the temporary and COVID-19related supply bottlenecks begin to subside. Specifically, we expect it to average 5% this year but anticipate that it will slow to the 3% level in 2022. Yes, 3% is still higher than the Fed’s historical 2% longer-term target, but the market has been able to generate quite handsome returns historically in a 3% inflationary environment.

There are embryonic signs that inflationary pressures are peaking from these higher- than- normal levels at present…on the transportation front, logistics companies are starting to signal this, and shipping rates do look to have peaked as the chart below demonstrates.

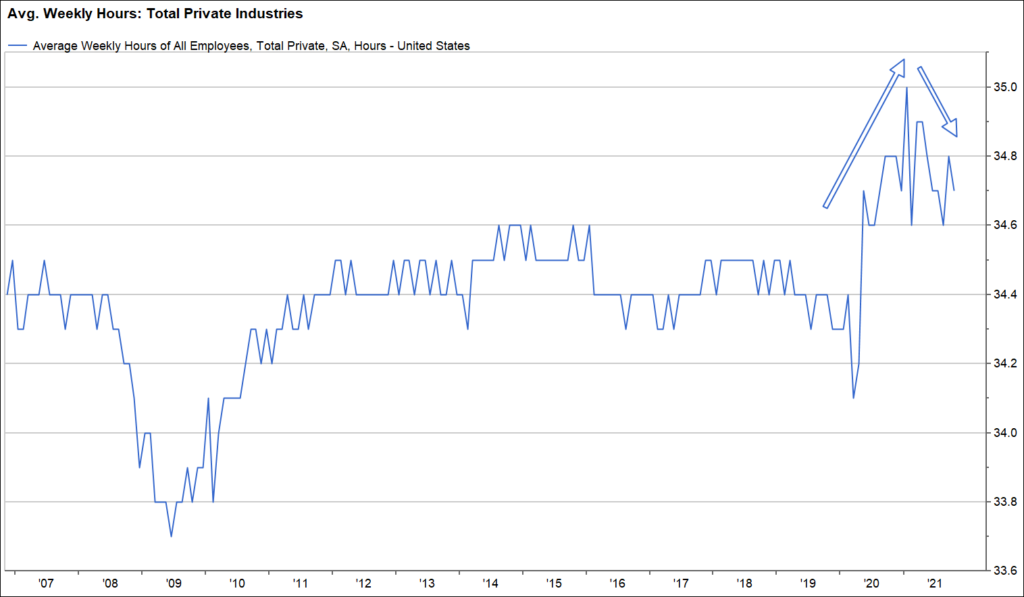

Semiconductor companies, such as Qualcomm, are also beginning to message that constraints are easing in Q4 on the product front. Auto sales increased in October, versus the prior month suggesting the same. In the most recent payroll report, average hours worked declined a bit, implying capacity might be improving slightly as more workers join the labor force.

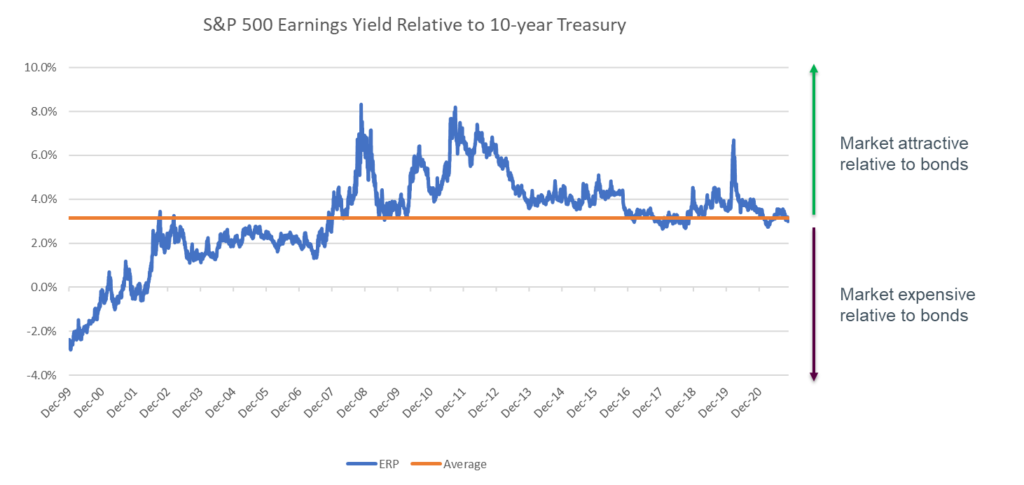

We will monitor these signs of peak bottlenecks closely. We do take comfort that the bond market believes inflation will be more of the benign variety. This is important to us as we believe the biggest risk to the market right now would be a surge in interest rates. After all, the low levels of rates on bonds are what makes stock valuation attractive today. We don’t see this changing in a significant way in the near term but will be watching closely.

We encourage investors not to become too optimistic or too pessimistic about this inflation issue.

How to Manage a Potential Correction

We haven’t seen more than a 6% pullback in over a year, and the S&P 500 has advanced a cumulative 74% over the last three years, or by more than 20% annually.7 Despite the healthy fundamentals and improved technical backdrop this fall, the odds of a correction have increased.

Catalysts could include a rise in interest rates, negative news in inflation or a shock event, such as the spread of resistant mutations in the COVID-19 virus, which could lead to additional unforeseen declines in economic activity and growth. We are not predicting a major market top; but even temporary, short-lived corrections can cause major market angst. For many investors, their allocation to stocks has likely drifted to higher-than-normal levels given the magnitude of the advance this year and in years prior. In these situations, it makes sense to reduce the allocation back to normal long-term strategic levels so that they are well-positioned to take advantage of opportunities when/if a correction occurs. This facilitates capitalizing on our positive, longer-term 12- to 15-month view.

Wrap-up

The quote from Ben Graham above highlights the fact that it is the “arithmetic” or the data that ultimately drives market returns, not unfounded optimism. 2021 has been an outstanding year for equity returns as we head into its final month. We believe this is indeed based upon the solid fundamental, valuation and technical data that we monitor. In short order, we will be publishing our crystal ball market outlook for 2022. We are pleased that our positive message for 2021, that we introduced back in January, played out as we expected. We may not have forecast returns as robust as 25% for the year, but we are glad that we got the trend correct and encouraged investors to stay invested throughout. We expect positive returns to repeat in 2022, and we look forward to presenting our thoughts in detail early in the new year.

Sources:

1 FactSet Data

2 Reuters

6 FactSet Earnings Insight

7 FactSet Data

The S&P 500 Index is a market-value weighted index provided by Standard & Poor’s and is comprised of 500 companies chosen for market size and industry group representation.

The impact of COVID-19, and other infectious illness outbreaks that may arise in the future, could adversely affect the economies of many nations or the entire global economy, individual issuers and capital markets in ways that cannot necessarily be foreseen. The duration of the COVID-19 outbreak and its effects cannot be determined with certainty.

This commentary is limited to the dissemination of general information pertaining to Mariner Platform Solutions’ investment advisory services and general economic market conditions. The views expressed are for commentary purposes only and do not take into account any individual personal, financial, or tax considerations. As such, the information contained herein is not intended to be personal legal, investment or tax advice or a solicitation to buy or sell any security or engage in a particular investment strategy. Nothing herein should be relied upon as such, and there is no guarantee that any claims made will come to pass. Any opinions and forecasts contained herein are based on information and sources of information deemed to be reliable, but Mariner Platform Solutions does not warrant the accuracy of the information that this opinion and forecast is based upon. You should note that the materials are provided “as is” without any express or implied warranties. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Past performance does not guarantee future results. Consult your financial professional before making any investment decision.

Investment advisory services provided through Mariner Platform Solutions, LLC (“MPS”). MPS is an investment adviser registered with the SEC, headquartered in Overland Park, Kansas. Registration of an investment advisor does not imply a certain level of skill or training. MPS is in compliance with the current notice filing requirements imposed upon registered investment advisers by those states in which MPS transacts business and maintains clients. MPS is either notice filed or qualifies for an exemption or exclusion from notice filing requirements in those states. Any subsequent, direct communication by MPS with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For additional information about MPS, including fees and services, please contact MPS or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you invest or send money.

Investment Adviser Representatives (“IARs”) are independent contractors of MPS and generally maintain or affiliate with a separate business entity through which they market their services. The separate business entity is not owned, controlled by or affiliated with MPS and is not registered with the SEC. Please refer to the disclosure statement of MPS for additional information.