Inflation pressures are building. People across the spectrum are asking what inflation will look like going forward. I don’t think that is the proper, operative question to ask. I think it’s more important to ask, “How long 2%+ inflation will be with us, and what will inflation be in relation to expectation?” I would like to address both questions.

Along with much of the economic world, I have increased my outlook for 2021 inflation. The “transitory” items that mathematically were supposed to occur in the August/September reports were overshadowed by higher pricing pressures from energy, transportation and housing costs. I am raising my inflation forecast to 4.5% this year, up from 3.5%, and increasing my outlook for inflation next year from 2.5% to 3.0%.

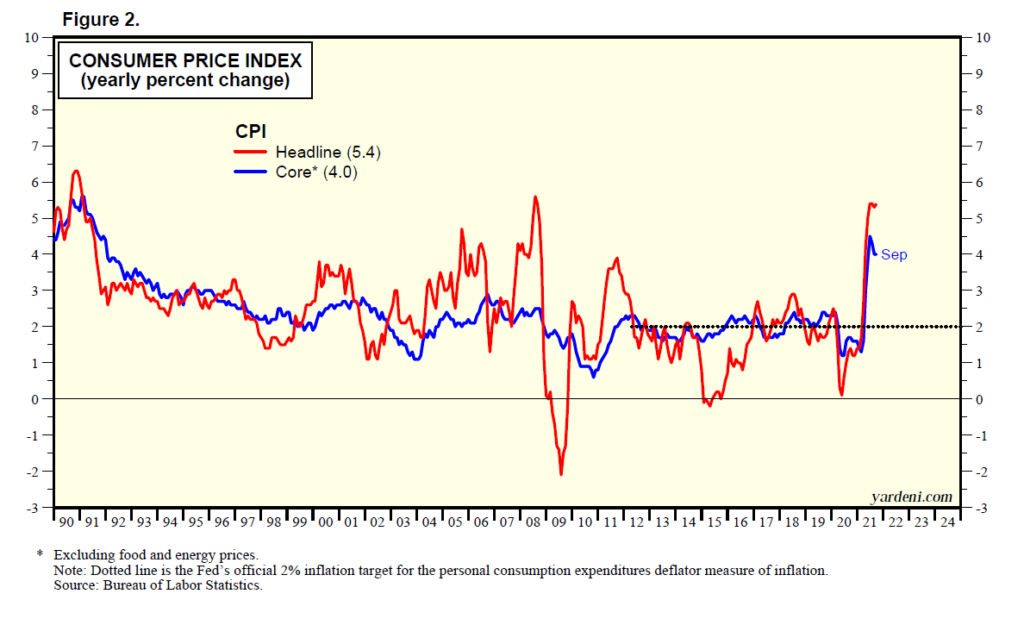

The Federal Reserve and others have increased their own inflationary expectations. According to the Fed, we will see inflation above 4% for this year. Note the chart above, which shows Consumer Price Index (CPI) and all items and core data overlaid on the Fed’s desired 2% range. Inflation has been running at the highest premium to that target in years, and 4% inflation this year seems to be certain. Will we see a similar number next year? If wage (employee compensation) costs, which have risen by more than 5% over the last year1, continue to rise, I think inflation, and importantly inflation expectations, should continue to remain sticky on the upside.

Businesses are starting to face the reality that, due to bottlenecks on the supply side of their work process (labor costs and availability are included in this statement), they may need to either raise prices or suffer a contraction in profit margins. Neither is a comfortable event for consumers or businesses in general. We are starting to get a strong whiff of “cost-push” inflationary pressures.

Consequently, due to the items mentioned above, the risk of the economy being in a renewed period of slightly higher-than-normal inflationary pressure appears to be building. We need to remember that the average annual all-items CPI has been 3.45% since the end of World War II.2 So, contrary to popular belief, the recent 10-year period when inflation averaged less than 2% was the outlier and not the normal experience. Most outlying economic events prove to be unsustainable. The period of deflation/disinflation is proving to be no exception to this rule.

Until recently, the Fed has held the view that the current upward push in inflation is “transitory,” or short term in nature. It is now becoming obvious to most that our current experience with inflation isn’t all “transitory.” Fed Chair Jerome Powell recently stated the inflation problem isn’t as transitory as he originally thought. There was massive spending and support plans during the pandemic. The government stimulated demand yet did little to stimulate supply after mandating the shutdown of major portions of the economy. As I have consistently stated in previous writings, when demand increases and supply remains the same, economic laws state that prices increase, or supply is “rationed.”

In a recent Wall Street Journal article,3 economists who were polled now expect inflation to run hot to the end of this year. Those polled are calling for inflation of 5.25% for 2021 (our current call is 4.5%).

That same group believes inflation will be 2.6% by the end of 2022 (our call is 3.0% next year). These expectations, if accurate, will represent an average inflation rate of 3.8% for the two years ending 2022; more than double the average inflation rate we saw over the previous decade at 1.8%.4

In addition to higher-than-expected inflation pressure, the average polled economist in the article now thinks economic growth will be lower in the second half of the year than previously thought. If current expectations are met, 2021 GPD growth would come in at 5.2% (our current outlook is calling for 5.5%). The economists are pointing toward “supply bottlenecks” as the prime reason behind the expected growth deceleration. Many in the poll suggest it will take to at least the second half of 2022 for the supply bottlenecks to recede.

As a side item, more than half the economists polled believe the Fed will have to raise interest rates by the end of 2022 to begin to stem the rising inflationary tide.

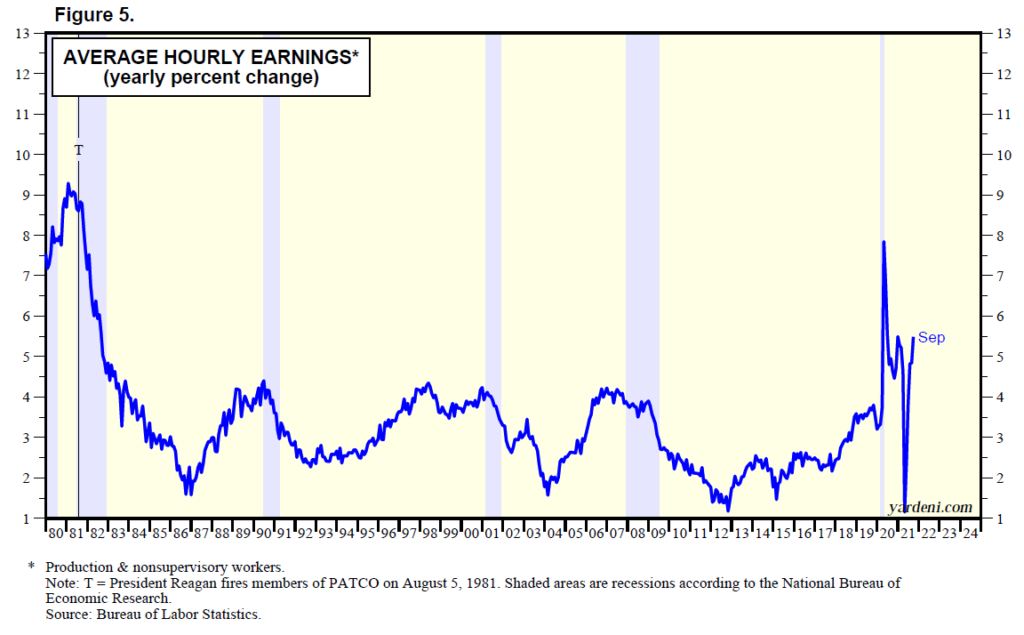

In the meantime, one of the supply “bottlenecks” creating upward pressure on inflation is the jobs market and the price of labor, as noted in the wage-cost chart above. Another article in The Wall Street Journal states that union leaders are pressing to increase their ranks and secure gains for their members as workers demand more from their employers (higher wages and better benefits).5 Consider the following excerpts from the article:

- Recently, Deere and Co., Mondelez (Nabisco), commercial truck manufacturer Volvo and breakfast food producer Kellogg all experienced worker walk-outs or stoppages, with workers demanding higher wages and better benefits.

- “There is a new militancy out there, and I do think it is an opportunity for labor” said James P. Hoffa, president of the Teamsters labor union, which represents 1.4 million workers, including Detroit auto workers and package delivery drivers.

- The film and television industry narrowly avoided a shutdown of production after the stage workers’ union reached a tentative agreement with studio and streaming services over worker demands.

- Many companies, in response to tight labor markets for lower wage workers, have been raising pay, offering signing bonuses, and improving benefits, to stay competitive.

The latest job’s market report from the Department of Labor, which came out at the beginning of October, showed much lower hiring had occurred during the month of September than many had been anticipating, highlighting the possibility that people are deciding to stay home, due to either COVID worries, or due to lower-than-desired pay. Wages rose 0.6% in September; the highest rate of increase since April. The labor force is still down about 4.9 million workers6 since the start of the pandemic. It now looks like many of those workers may indeed not return to the labor force.

On top of this, the retirement rate has recently accelerated, further straining the labor market, as many baby boomers decided to call it a day and retire. But the official unemployment rate is now 4.8%; a low level from a historical standpoint.

The Saving Grace of Productivity Growth

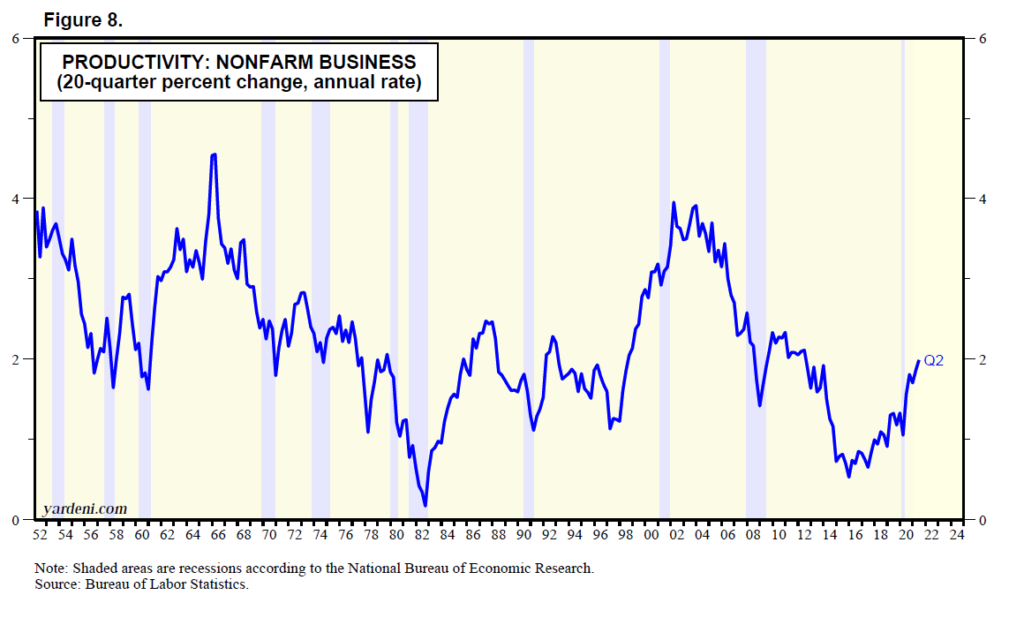

If the sharp edge of rising wages is to be blunted, and inflation is to remain low, labor productivity growth needs to be strong. If labor productivity is at 2% on a sustainable basis, that should provide the average company with the needed additional cash flow to fund 4% wage growth rates, without the need to dramatically increase prices.7 Recently, worker productivity is running at about 2% on a rolling, 20-quarter view (See Productivity: Nonfarm Business chart.).

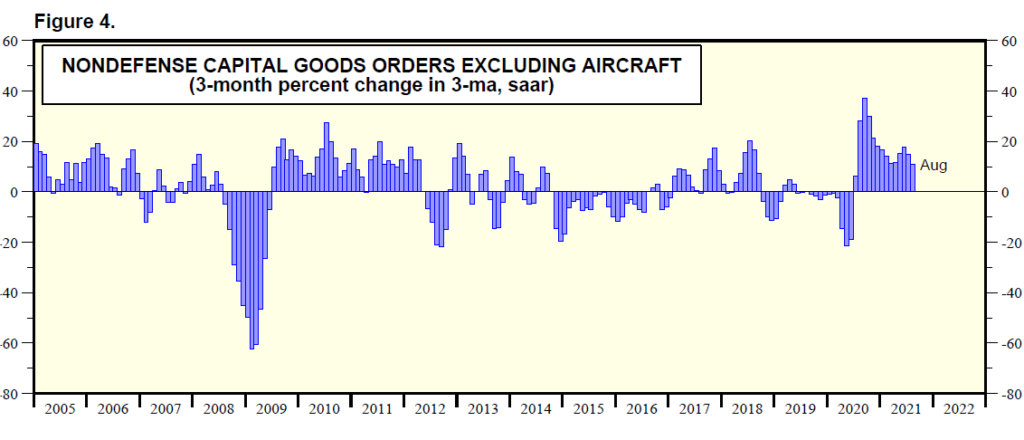

Productivity growth is driven by capital spending. Note the “Nondefense Capital Goods” chart, which shows the rate of change of nondefense capital goods order growth, excluding aircraft. This data series represents more of a “pure” view of capital spending trends. While the latest read shows a slowing in growth in capital spending, the rate is still robust. This, along of course with data on productivity, will give us signs as to the sustainability of 4%+ inflation rates. I stand by my outlook that CPI all-items growth will decelerate in 2022 from the 4%+ rate in 2021.

Where This Leaves Us

Getting back to the current labor market profile, it has become apparent that current monetary policy and Fed forecasts have been built on the belief that the jobs market will eventually return to a pre- COVID level. That expectation now seems overly optimistic, at least over the short/intermediate term. If that is the case, and we see further strains on the labor market, driving cost-push inflation upward, where does that leave investors?

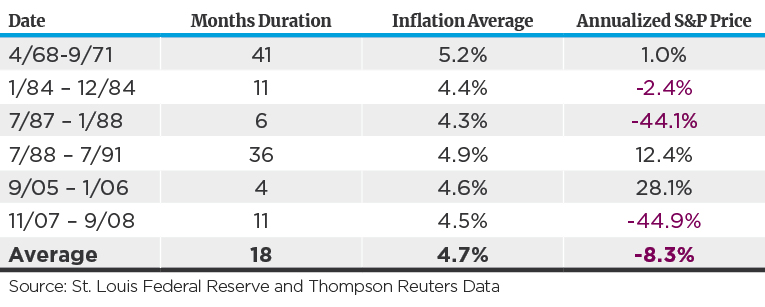

To answer that question, what if we are in a period in which inflation will remain 4%+ or slightly higher than normal? What has happened to the stock market during previous periods when inflation was 4% or higher? I’m not talking about hyper-inflation here, a pricing environment few, if any, are really expecting. No, I’m talking about periods in which inflation was rising at a higher-than-average rate.

We have several periods when inflation was consistently running at a 4%+ rate in the past but didn’t accelerate dramatically higher. Below find data for these periods:8

As noted, the S&P 500 has struggled on average during times of moderately above-average inflation pressure. It is also interesting to note that two of the last three major stock market declines (1987 and 2008) occurred when inflation was running “hotter” than normal.

If we exclude these two negative periods, where it is easy to argue that the driver behind bad equity returns had little to do with moderately high inflation rates, the annualized average change in the S&P 500 was +9.7%. This is in line with longer term historical norms. Based on historical standards, the risk of a significantly negative stock market reaction during times of sustained, higher-than- normal inflation has been present, but not “mandatory.” History tells us that inflation, in and of itself,

doesn’t necessarily create negative equity returns. Moderate inflation (3% – 4%) has tended to foster reasonable stock market returns.

Currently, long-term, market-based inflation expectations are running around 2.4% per year over the next number of years per the spread of pricing between U.S. Treasury yields and corresponding TIPS yields. In my opinion, the real question we have here isn’t, “What exactly, will inflation be?” No, the real issue at hand is two-fold.

- First, I suspect the days of deflation/disinflation risks being of prime importance may be behind us. If so, this is a major development, driving public and private policy and could radically change serious money capital allocation decisions over the next number of years.

- Secondly, as far as short-term capital market reactions to inflation, the key once again isn’t the exact inflation rate. Rather, the driver is what will inflation be in relation to investor expectations. That should, over shorter periods of time, affect asset pricing levels.

The Fed to the Rescue?

If my worries about the sustainability of higher-than-expected inflation hold water, then the Fed will eventually step up and take care of the problem, right? This is a key question. Remember that Fed policies, by the Fed’s own insistence, is “data dependent.” Most economic data tends to be backward- focused. So, the risk of inflation becoming more ingrained in our economy prior to the Fed acting to control this problem is real as the Fed historically has been “reactionary” rather than “anticipatory” in its policy changes.

If consumers and businesses start to view inflation as not just a risk, but as a baseline issue, then the Fed won’t have an option but to fight inflation. The only way I know for the Fed to fight systemic inflation pressure is to raise interest rates and/or let the currency depreciate. Both actions spur economic growth weakness.

That is the dark nightmare of the inflation picture. Again, this dark environment isn’t currently expected to transpire.

All of that being said, I have long been expecting the Fed to start their bond purchase taper process by the end of this year and start to raise interest rates by the end of 2022, preceded by a steepening of the yield curve. I continue to stand by those expectations.

Final Word

In my opinion, the world’s economy has passed through the secular period of deflation/disinflation pressure being the watchword for capital market pricing and central bank policies. I also believe inflation won’t get out of hand, but at times may be more intense than many currently expect.

Sources:

1 Bureau of Labor Statistics

2 St. Louis Federal Reserve

3 The Wall Street Journal, “More Inflation, Less Growth Forecast”

4 St. Louis Federal Reserve

5 The Wall Street Journal, “Unions Push for Advantage Amid a Tight Labor Market” 6 Barron’s

7 The Wall Street Journal, “Investors Pin Hopes on Productivity”

8 St. Louis Federal Reserve and Thompson Reuters

The S&P 500 Index is a market-value weighted index provided by Standard & Poor’s and is comprised of 500 companies chosen for market size and industry group representation.

This commentary is limited to the dissemination of general information pertaining to Mariner Platform Solutions’ investment advisory services and general economic market conditions. The views expressed are for commentary purposes only and do not take into account any individual personal, financial, or tax considerations. As such, the information contained herein is not intended to be personal legal, investment or tax advice or a solicitation to buy or sell any security or engage in a particular investment strategy. Nothing herein should be relied upon as such, and there is no guarantee that any claims made will come to pass. Any opinions and forecasts contained herein are based on information and sources of information deemed to be reliable, but Mariner Platform Solutions does not warrant the accuracy of the information that this opinion and forecast is based upon. You should note that the materials are provided “as is” without any express or implied warranties. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Past performance does not guarantee future results. Consult your financial professional before making any investment decision.

Investment advisory services provided through Mariner Platform Solutions, LLC (“MPS”). MPS is an investment adviser registered with the SEC, headquartered in Overland Park, Kansas. Registration of an investment advisor does not imply a certain level of skill or training. MPS is in compliance with the current notice filing requirements imposed upon registered investment advisers by those states in which MPS transacts business and maintains clients. MPS is either notice filed or qualifies for an exemption or exclusion from notice filing requirements in those states. Any subsequent, direct communication by MPS with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For additional information about MPS, including fees and services, please contact MPS or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you invest or send money.

Investment Adviser Representatives (“IARs”) are independent contractors of MPS and generally maintain or affiliate with a separate business entity through which they market their services. The separate business entity is not owned, controlled by or affiliated with MPS and is not registered with the SEC. Please refer to the disclosure statement of MPS for additional information.