“After spending many years on Wall Street and after making and losing millions of dollars, I want to tell you this…it never was my thinking that made big money for me. It always was my sitting. Got that? My sitting tight!” – Jesse Livermore (famous investor/trader in the 1920s and 1930s)

On the surface, and at a high level, not much has changed. Economic growth continues to be solid, albeit the pace has moderated from earlier v-shaped recovery levels. Earnings growth is robust, interest rates remain very low, and credit spreads are extremely tight. While the Federal Reserve has signaled it will soon be ready to taper its quantitative easing by reducing monthly bond purchases gradually over time, it confirmed that it is maintaining an accommodative stance with interest rate hikes still anticipated to be well off into the future, beginning in the second half of 2022 at the earliest and perhaps not until 2023. According to the Fed’s dot plots, it doesn’t even expect the Federal Funds rate to rise to 1% until the end of 2023.1 With that backdrop, the market has continued to climb a wall of worry with S&P 500 year-to-date returns of 15.9% through September, despite the negative 4.7% return posted this past month.2 The month of September has been historically rocky with average price returns of roughly -1.1% based on figures going back to 1928.3

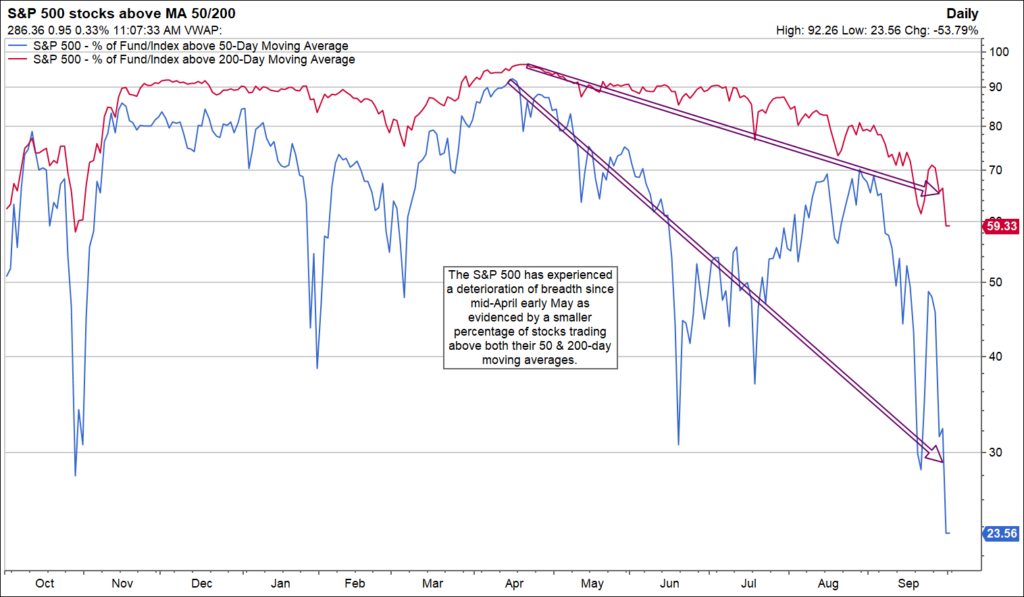

While our target for the S&P 500 continues to be as high as 5000 by mid-2022, and our message of staying invested in equities is unchanged, there is a bit of nuance to our outlook. We cannot ignore that the wall of worry is getting larger and a little more complex. In addition, market leadership appears to be narrowing. On this latter point, the S&P 500 is roughly 5% off of its high at September month-end, yet the average stock is off over 13%…fewer stocks are lifting the overall index than we saw earlier in the year when leadership was broad. Only 24% of stocks are currently trading above their 50-day moving average; a figure that is well down from what we saw earlier in the year.

Source: FactSet

This narrowing is one of several signs that tends to precede more sustained corrections in the market, so this has our attention and makes us more cautious. But real periods of market challenge are generally accompanied by deteriorating fundamentals as well, which is not the case today. It is the continued attractive fundamentals outlined above that give us confidence that the market should continue to advance as we move through 2022. That said, we do believe risk levels have risen. This is a time to channel Jesse Livermore and his plea not to overthink the yin and yang of current headline news but rather to sit tight at allocations that are strategically normal and appropriate for you for the long term.

Rising Risk Levels in The Near Term—Manageable But We’re Watching Closely

As you know, we keep close tabs on what we refer to the rolling wall of worry— headline items and concerns that are front and center in investors’ minds. Top of the list at present include:

- Concerns that rising inflation will remain more than transitory

- Angst that Washington policy will lead to higher taxes and lower earnings growth in 2022

- Anxiety about the looming debt ceiling discussions and fear of another untimely government shutdown

We do believe these items will be adequately managed and worst-case outcomes should be avoided, but that they will probably lead to rising volatility and risk of temporary market pullbacks that are very unpredictable as to timing. Let’s examine each in more detail.

Inflation—Transitory or Sticky?

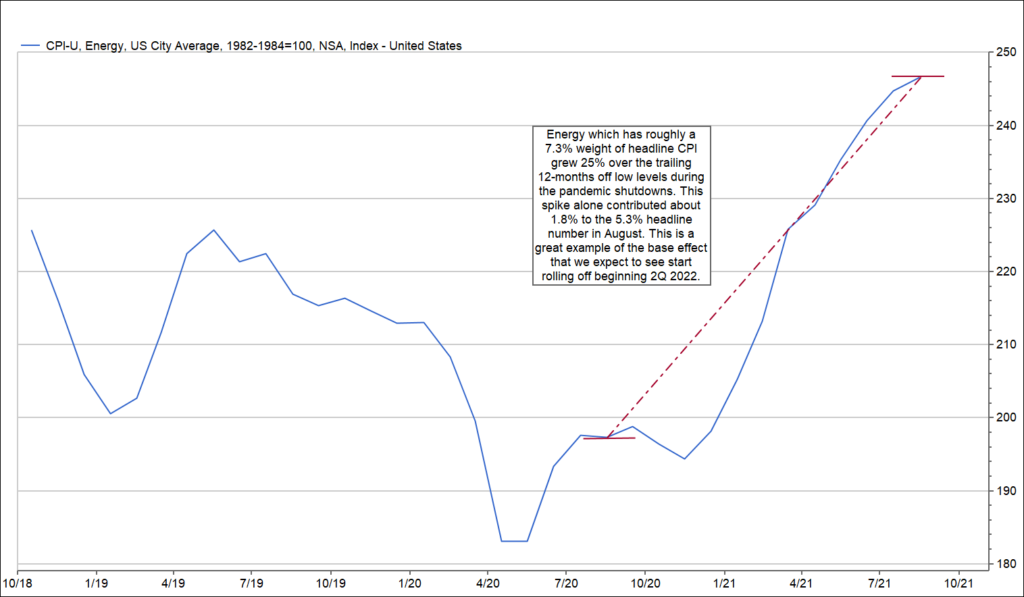

This is a key debate that is ongoing. From our perspective, a portion of the recent acceleration is transitory. First, there is a base effect that is occurring. The significant decline in prices that took place during the economic shutdown in 2020 established a much lower base as the comparator to calculate current consumer price inflation (CPI). This exaggerates the real underlying rise in inflation versus using the higher pre-pandemic level as the price base to judge how much prices have risen. The following chart on the rate of increase in energy prices illustrates this point.

Source: FactSet

The chart captures the 2020 swoon in energy prices as well as the sharp rebound off that lower base beginning in May 2020. Yes, energy prices are up 25% on a year-over-year basis through August from these lower base levels, but they have only advanced by single-digit percentage terms versus the pre- pandemic period. In the aggregate, CPI for all items is being reported at more than 5% over the past year through August. However when examined over a two-year stacked basis, which considers the steep decline in prices that occurred in 2020, the annualized rate over this two-year period is running closer to 3%. Still higher than prior to COVID, but below these very robust levels in the headlines at present. Once these lower base levels roll off and anniversary, inflation should moderate.

An additional item that suggests to us a healthy portion of this rise in inflation is transitory is the impact of current supply chain bottlenecks that are longer in tooth than expected but that will soften and that are more temporary in nature.

A key reason we believe troublesome levels of inflation, such as those experienced in the 1970’s and 1980’s, will be avoided is the current behavior of bond investors. If inflationary expectations were truly becoming a real problem, we would expect to see rates on longer term bonds rising briskly…that simply isn’t happening. The prices of other inflation hedges such as gold and silver also are very quiet. We will be watching trends here closely.

Further, we are impressed by the solid trends in labor productivity that provide the flexibility of companies to increase wages without suffering from meaningful margin degradation. We do not see the makings of an ugly wage-price spiral forming at present.

Bottom-line is that we do see inflation running hotter than we are accustomed for a bit, given current supply chain challenges and labor shortages associated with COVID but expect it to slow to the 3% level in 2022 as these bottlenecks gradually subside. The equity market should embrace this moderating trend.

Impact of Potential Change In Tax Policy

The news flow regarding the potential outcome of the $3.5 trillion budget resolution package to fund various educational, healthcare, environmental and other social programs outlined by Democrats is rather volatile. Final proposed legislation is likely to be watered down from this original package given passionate debates between the more progressive and moderate camps of the party as to structure and size of the bill. All possible scenarios, though, include tax hikes as a component of the likely bill.

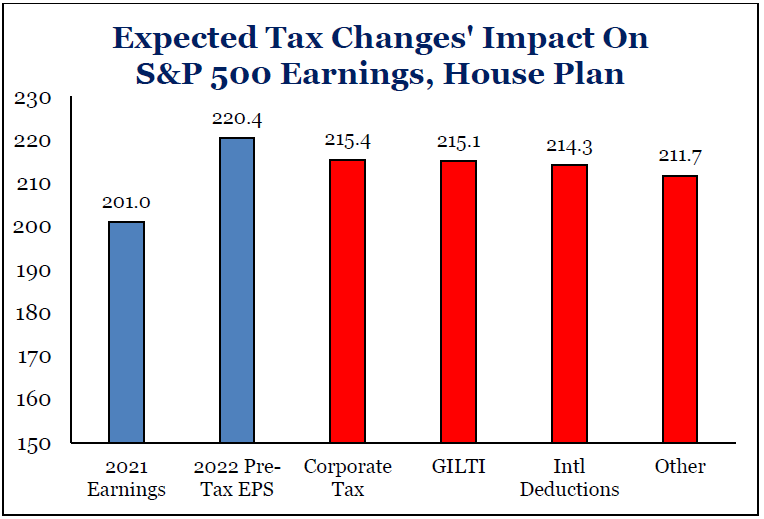

Current betting odds place over a 70% probability that, generally speaking, wealthy Americans will face higher taxes in 2022.4 The question from an investment standpoint centers on the potential impact to earnings if corporate and individual tax rates rise. In examining the math on this, we turn to political analysts who closely follow the glide path of these discussions in Washington D.C. Dan Clifton at Strategas has done considerable work in this area. The chart below illustrates that while we will see some earnings dilution if tax hikes are implemented, it should be rather moderate.

Source: Strategas

Specifically, per Strategas, estimated S&P 500 EPS is likely to be revised down to $210 per share from $220 per share if they go through. This would reduce expected earnings-per-share growth to 5% from 10%, but this is definitely a manageable result. This would cause us to adjust our upside S&P 500 target for mid-2022 to 4800 from 5000, but that would still represent high, single-digit returns from current levels.

Debt Ceiling Discussions

As of this writing, the Senate advanced a standalone bill that would lift the statutory limit on federal borrowing until December 2022. It remains to be seen who in Congress will act to lift the debt ceiling but is clear a first-time default on federal debt is not desirable. These debates about raising the debt ceiling to allow for increased government spending is nothing new in our capital. They have occurred quite often, and it is never fun to watch, but cooler heads have prevailed historically to fund the government and return to business as usual. More recent examples include 2011, probably the most serious example when U.S. Treasury debt was downgraded, as well as 1995-96 and 2013. The average decline over these three periods of debt ceiling concerns was roughly 12%. This provides some perspective on the magnitude of drawdown risk if these discussions linger through the month of October. The key to us is that these tend to be temporary distractions and market attention returns to fundamental drivers of the economy and earnings which at present are positive.

Wrap-Up

As always, we focus on the data to drive our decisions. In that regard, the economy and earnings continue to perform in a manner supportive of additional stock market gains over the next 12-15 months. With the average stock down over 13% from recent highs, perhaps a stealth correction has already occurred. Perhaps the overall index, which still trades at close to record highs, will see additional downside, and we’ll experience a broader correction.

We could see either of these scenarios playing out. Given the solid fundamental backdrop, though, a broader correction should be short-lived. The years 2018 and 2020 are great examples that illustrate the cost of taking premature action and selling stocks in anticipation of a temporary pullback… suffering from whiplash and missing the swift recovery that follows. Could the market move to higher highs and approach our 5000 target without interruption if the economy continues to reopen and investors gain more confidence that inflation will remain calm? Absolutely. We think this is a time in which the more permanent trendline is still up, but risk levels have increased. In that environment we want to hug close to normal longer-term strategic equity allocations and avoid taking a more optimistic or pessimistic approach.

Sources:

1 “Federal Reserve Summary of Economic Projections”

2 FactSet

3 FactSet Historical Data Compilation

4 Strategas

The S&P 500 Index is a market-value weighted index provided by Standard & Poor’s and is comprised of 500 companies chosen for market size and industry group representation. It is not possible to invest directly in an index.

The tax laws discussed are proposed at the time and any final laws or regulations passed may vary significantly from the proposed. Tax laws and regulations are complex and subject to change, and we cannot guarantee that the information herein is accurate, complete, or timely. Any changes to the proposed may also affect any illustrations used in this presentation.

This commentary is limited to the dissemination of general information pertaining to Mariner Platform Solutions’ investment advisory services and general economic market conditions. The views expressed are for commentary purposes only and do not take into account any individual personal, financial, or tax considerations. As such, the information contained herein is not intended to be personal legal, investment or tax advice or a solicitation to buy or sell any security or engage in a particular investment strategy. Nothing herein should be relied upon as such, and there is no guarantee that any claims made will come to pass. Any opinions and forecasts contained herein are based on information and sources of information deemed to be reliable, but Mariner Platform Solutions does not warrant the accuracy of the information that this opinion and forecast is based upon. You should note that the materials are provided “as is” without any express or implied warranties. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Past performance does not guarantee future results. Consult your financial professional before making any investment decision.

Investment advisory services provided through Mariner Platform Solutions, LLC (“MPS”). MPS is an investment adviser registered with the SEC, headquartered in Overland Park, Kansas. Registration of an investment advisor does not imply a certain level of skill or training. MPS is in compliance with the current notice filing requirements imposed upon registered investment advisers by those states in which MPS transacts business and maintains clients. MPS is either notice filed or qualifies for an exemption or exclusion from notice filing requirements in those states. Any subsequent, direct communication by MPS with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For additional information about MPS, including fees and services, please contact MPS or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you invest or send money.

Investment Adviser Representatives (“IARs”) are independent contractors of MPS and generally maintain or affiliate with a separate business entity through which they market their services. The separate business entity is not owned, controlled by or affiliated with MPS and is not registered with the SEC. Please refer to the disclosure statement of MPS for additional information.