Most of us try to do our part for the environment. We recycle. Some of us buy hybrid cars. Most of us also tend to support social causes we believe in, and that sense of social and environmental responsibility often carries over into the products we buy and how we choose to invest.

More Individuals Are Investing Sustainably

While there are many names for it—socially responsible investing, environmental, social and governance (ESG) investing, values-based investing, impact investing, most fall under the umbrella term of “socially conscious investing.” More and more individuals and institutional investors alike are investing their dollars to align with their values, and it shows.

According to a 2020 Report on U.S. Sustainable and Impact Investing Trends by the US SIF Foundation, total U.S.-domiciled assets under management using sustainable investing strategies has grown 42% in the last two years. Assets grew from $12 trillion in 2018 to $17.1 trillion in 2020. Put another way, sustainable investing represents one in three dollars of the total U.S. assets under professional management.1

The report also notes that retail and high-net worth individuals are increasingly using this approach, investing $4.6 trillion in sustainable investment assets; a 50% increase from 2018.

Investors Don’t Have to Trade Values for Return

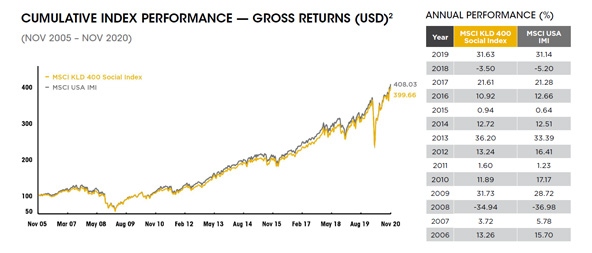

While it may seem unlikely to some, data supports the fact that incorporating values into investment decision-making does not negatively affect performance. In other words, you don’t have to trade your values for positive returns.

In addition, a 2020 Morgan Stanley report concluded that, “sustainable investing is proving a rewarding opportunity during times of both market expansion and severe volatility.” The report also said that, despite the pandemic, in the first half of 2020, sustainable equity and taxable bond funds outperformed their traditional peers. The research included the performance of nearly 11,000 U.S. mutual funds and exchange traded U.S.- domiciled funds. The results showed that incorporating ESG criteria can potentially provide financial returns that are comparable if not better than traditional funds with less downside risk.3

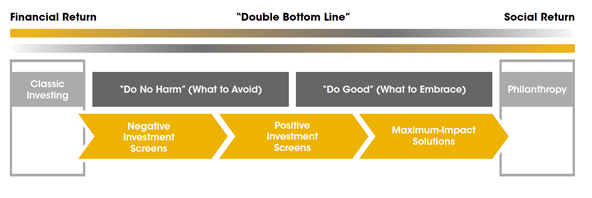

Negative and Positive Screening

To help advise individuals on where to put their investments, screening technology allows portfolio managers to select stocks according to an investor’s personal preference. For example, an investor may want to screen out tobacco or oil companies.

Investors can even access free screening tools, such as the one from Morningstar. The firm acquired Sustainalytics in 2020 and has since launched a free ESG screening tool to help both investors and financial advisors screen funds focused on ESG issues. The tool allows for a detailed look at funds that exclude guns, tobacco, alcohol, fossil fuels and thermal coal.4

If you are interested in sustainable investing, there are two primary investment objectives beyond the traditional goals of maximizing return and minimizing risk to help you make strategic decisions:

- Do No Harm – Consider avoiding investments in companies that take a stance or profit from activities that conflict with your values. These are “negative” screens of companies or industries to be avoided, such as tobacco, gambling, oil and gas, defense, etc. Obviously, one person’s idea of socially responsible investments can be completely different from another person’s. The key is to differentiate between all of the available fund options and select those that most accurately reflect your values. The Forum for Sustainable & Responsible Investment is a good place to start. For those with a faith-based or religious perspective, the Christian Investment Forum can be helpful.

- Do Good – Actively seek out investments in companies that create real value for their customers, communities and society at large. This approach often applies the aforementioned ESG factors as positive screening criteria.

It is helpful to think of parallels to the medical industry. Physicians take an oath to “do no harm.” It is fundamental to the practice of medicine. The goal is certainly not to stop there—the ultimate goal of medicine is to heal. Likewise, investors who want to integrate their values with investment decision-making may decide to not merely seek to avoid companies doing harm, but ultimately look for companies that heal; those that are helping to make the world a better place.

Factors for Investors to Consider Before Investing

As you work with your wealth advisor on how socially conscious investing fits into your overall financial strategy, consider approaching it as you would any investment. What are your long-term goals and time frame for reaching them and what level of risk are you comfortable with in your portfolio? Your wealth advisor will listen to what matters most to you to help align your portfolio with your values.

Disclosures

1 US SIF Trends Report Highlights, ussif.org.

2“MSCI KLD 400 Social Index,” msci.com.

3“Sustainable Reality: 2020 Update,” Morgan Stanley.

4 “Morningstar Rolls Out Free ESG-Screening Tool,” investmentnews.com.

The MSCI KLD 400 Social Index is a capitalization weighted index of 400 US securities that provides exposure to companies with outstanding Environmental, Social and Governance (ESG) ratings and excludes companies whose products have negative social or environmental impacts.

The MSCI USA IMI is an equity index of large, mid and small cap companies. The Index is designed for investors seeking a diversified benchmark comprised of companies with strong sustainability profiles while avoiding companies incompatible with values screens.

The views expressed are for commentary purposes only and do not take into account any individual personal, financial, legal or tax considerations. As such, the information contained herein is not intended to be personal legal, investment or tax advice. Nothing herein should be relied upon as such, and there is no guarantee that any claims made will come to pass. The opinions are based on information and sources of information deemed to be reliable, but Mariner Platform Solutions does not warrant the accuracy of the information.

Investment advisory services provided through Mariner Platform Solutions, LLC (“MPS”). MPS is an investment adviser registered with the SEC, headquartered in Overland Park, Kansas. Registration of an investment advisor does not imply a certain level of skill or training. MPS is in compliance with the current notice filing requirements imposed upon registered investment advisers by those states in which MPS transacts business and maintains clients. MPS is either notice filed or qualifies for an exemption or exclusion from notice filing requirements in those states. Any subsequent, direct communication by MPS with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For additional information about MPS, including fees and services, please contact MPS or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you invest or send money.

Investment Adviser Representatives (“IARs”) are independent contractors of MPS and generally maintain or affiliate with a separate business entity through which they market their services. The separate business entity is not owned, controlled by or affiliated with MPS and is not registered with the SEC. Please refer to the disclosure statement of MPS for additional information