“Successful investing is about managing risk, not avoiding it.” – Ben Graham

The market has been anything but boring over the last 15 months. After the 35% swift decline in March 2020, amidst peak pandemic fears, the S&P 500 has rallied over 85% from that low point in robust, head-spinning fashion and now stands at close to all-time highs. This index is up almost 40% over the last 12 months, ended May 31, and up over 12% on a year-to date basis.1

This impressive strength exhibited by large-cap stocks in the U.S. coupled with periodic surges in more speculative financial assets, e.g., bitcoin and GameStop, has inspired some folks to hint that we are approaching bubble-like levels in equities and/or that we are close to a stock market peak. We’ve been very clear about our take on such assertions…we don’t think so. While we would not be surprised to see volatility in the market rise in the second half and even for the S&P 500 to take a respite and tread water over this time frame on the heels of the recent price strength we’ve enjoyed, the backdrop remains entirely too favorable to fade stocks at this juncture. Importantly, we do look for higher highs to develop over the next 12 months as we move through 2022.

Yes, there are several important wall of worry items that are causing investor angst at the moment. Chief among them: the specter of rising inflation, concern about potential tax hikes in 2022, and fear that U.S. economic data can’t get any better than this. These headline risk items comprise the “rolling wall of worry” that we monitor closely. Items on the list constantly need to be updated and examined, but they cannot be avoided and are always there. We believe these current specific risks are manageable at present.

Further, we truly don’t fret about them unless they spill over into the real metrics that drive the market—earnings and the economy. When we examine these important metrics, we continue to like what we see. Valuation is reasonable, not stretched and bubble-like. The economy continues to open up and has supported surprisingly strong earnings growth of roughly 50% in the first half of 2021.2 Leadership is broad, not narrow as seen when past bear markets were at hand. There are times to press the metal to the floor and expand equity exposure and times to prune risk and reduce exposure. Today we would do neither based on the overall positive fact set. Stay the course!

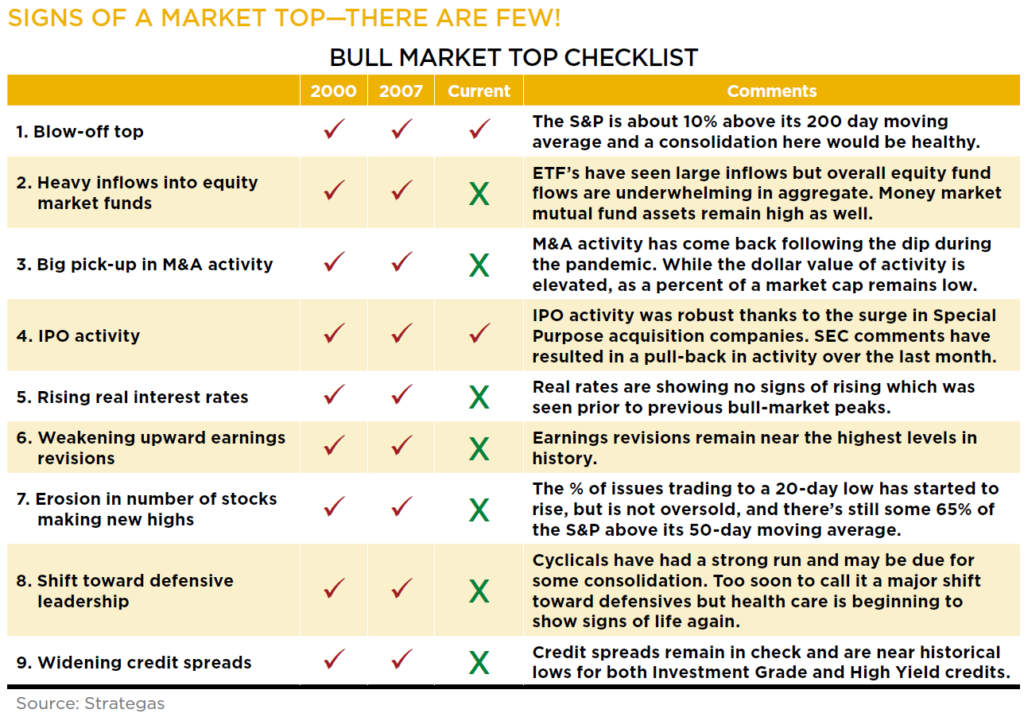

The chart above captures a number of signals that flashed major warning signs at prior market tops. You can see that many were in play at the beginning of the last two major bear markets of 2000 and 2007/2008. Such negative signals are virtually nonexistent today. Yes, there are signs of a “blow-off top” or a relatively rare surge of momentum in stock prices that is embedded in the large percentage of stocks currently trading above their 200-day moving average, and IPO (initial public offerings) activity does stand at high levels. These do suggest caution. But none of the other critical data is concerning. Earnings estimates and profit margins continue to rise.

In terms of economic data, we continue to see record levels of strength in such items as real GDP (gross domestic product) growth that is expected to be close to 10% in Q2 in 2021. Unemployment claims that were just reported at the end of May were at the lowest levels since the pandemic began. Such a healthy pace or trend is likely to be sustained as the economy continues to open up comprehensively; to wit, airline passenger traffic continues to improve and now is back to 90% of the levels we saw at the start of the COVID-19 shutdown.3 Interest rates have risen but remain at low levels, and credit spreads remain tight. Both suggest the bond market is not overly worried about either recession or runway inflation. Monetary and fiscal policy remain supportive.

It’s simply hard to be negative when the data stacks up nicely like this.

Valuation—Not as Expensive as Advertised

The bear camp likes to harp on the fact that the forward P/E level of the S&P 500 stands at roughly 22 times, which is above the long-term average of 15.4 What is missing from this analysis is the current low level of interest rates and the very high levels of profitability of corporations at present. When the 10- year Treasury yield is at 5 or 6%, bonds compete handsomely with stocks for investor attention.

But with a S&P 500 dividend yield that is at virtual parity with the current 10-year Treasury yield of 1.6%, stocks look quite attractive and not over-priced. Further, given the record levels of profit margins that companies are enjoying, the earnings yield on stocks is roughly 2% higher than the interest rate paid on bonds.

This 2% spread is known as the equity risk premium or ERP. The 2% level is above the long-term average of 67 basis points and well above the -2% figure back in the 2000 bear market, for example. So, on these measures, stocks look reasonably valued and not concerning from our perspective.5

A couple of additional points to make in case one did want to focus on the fact that the 22 times P/E level on the S&P 500 is above the historical level. First, it has been stable and consistent at this multiple for some months as earnings have repeatedly been revised upward in positive fashion. As important, valuation concerns alone are not adequate reason to sell equities. Alan Greenspan uttered the words “irrational exuberance” in 1996, four years before the market peaked. In forming our opinion on the market, we develop a mosaic. When we evaluate the market, we look at three levels of analysis. Valuation is one of them. The other two are fundamentals (earnings, interest rates and the economy) and technical price trends. The latter two are currently decidedly positive. We do not find it wise to focus on one of the forms of analysis at the expense of the other two. All three provide a comprehensive view, and we find the aggregated data to tilt decidedly positive.

Inflation—A Key Wall of Worry Item

It’s interesting to us how inflation has suddenly become the risk topic du jour when it wasn’t even on the radar screen of many folks as we entered 2021. We listed it as a wildcard risk topic in our Crystal Ball Outlook presentation we outlined with clients back in January. Clearly it has moved swiftly from wildcard to a front and center concern to study. What’s our take? At present, we agree with the Federal Reserve and believe these are largely transitory price increases from lower base price levels experienced during the pandemic induced recession. This is their so-called “base effect” argument. For example, we are bound to see airline tickets and menu prices bounce significantly in one-time fashion as consumers begin to fly and go out to eat again.

Other reasons to believe inflationary pressures should ease and stabilize are several. As supply chain bottlenecks soften, pricing pressure from production shortages in such areas as autos and semiconductors should decline. Similarly, as schools reopen and special unemployment benefit payments expire, we should see more folks reentering the workforce and potential wage pressures from labor shortages moderate bit.

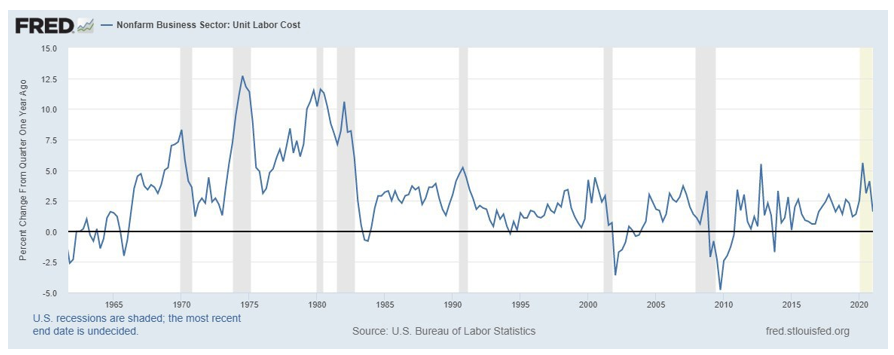

On the labor front, we are impressed by the strong improvement in labor productivity that is underway. The spike in efficiency and labor productivity has served to keep unit labor cost increases well in check at the 2% level as seen in the chart below. We are monitoring this closely. If this continues to be the case, we are unlikely to see the wage-price pressures that lead to unhealthy or bad inflation resulting in a significant reduction in profit margins and earnings growth.

Note in the chart that unit labor costs rose sharply in the 1970s, which contributed to the huge spikes in inflation in that decade. We do not anticipate this reoccurring to such a degree at this point.

As a final point, we find it interesting that the bond market does not seem overly worried with inflation. In past cost-push inflationary cycles, bond investors pushed up rates significantly that seemingly forced the Fed’s hand to raise short-term rates. One thing that would get us to change our mind would be if we began witnessing some of this inflation we are seeing in commodity prices spill over into bond market expectations and an associated feeling that the Fed is behind the curve and in need of raising short-term rates significantly…we do not think we are close to such events at this juncture!

Wrap-up

In our view, the wall of worry risks, while unavoidable and always out there, appear manageable at present. And the overall fundamental, valuation and technical backdrop is favorable. I’ll say it again… stay the course!

Sources:

1FactSet

2FactSet

3TSA.gov

4FactSet

5Strategas

The S&P 500 Index is a market-value weighted index provided by Standard & Poor’s and is comprised of 500 companies chosen for market size and industry group representation.

This commentary is limited to the dissemination of general information pertaining to Mariner Platform Solutions’ investment advisory services and general economic market conditions. The views expressed are for commentary purposes only and do not take into account any individual personal, financial, or tax considerations. As such, the information contained herein is not intended to be personal legal, investment or tax advice or a solicitation to buy or sell any security or engage in a particular investment strategy. Nothing herein should be relied upon as such, and there is no guarantee that any claims made will come to pass. Any opinions and forecasts contained herein are based on information and sources of information deemed to be reliable, but Mariner Platform Solutions does not warrant the accuracy of the information that this opinion and forecast is based upon. You should note that the materials are provided “as is” without any express or implied warranties. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Past performance does not guarantee future results. Consult your financial professional before making any investment decision.

Investment advisory services provided through Mariner Platform Solutions, LLC (“MPS”). MPS is an investment adviser registered with the SEC, headquartered in Overland Park, Kansas. Registration of an investment advisor does not imply a certain level of skill or training. MPS is in compliance with the current notice filing requirements imposed upon registered investment advisers by those states in which MPS transacts business and maintains clients. MPS is either notice filed or qualifies for an exemption or exclusion from notice filing requirements in those states. Any subsequent, direct communication by MPS with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For additional information about MPS, including fees and services, please contact MPS or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you invest or send money.

Investment Adviser Representatives (“IARs”) are independent contractors of MPS and generally maintain or affiliate with a separate business entity through which they market their services. The separate business entity is not owned, controlled by or affiliated with MPS and is not registered with the SEC. Please refer to the disclosure statement of MPS for additional information.