For those who haven’t been to Jackson Hole, Wyoming, you must go. This is one of the most scenic, beautiful areas in the U.S. Just south of Yellowstone National Park, Jackson Hole, along with western areas, such as Aspen, Vail and Park City, have garnered the attention of many big-money individuals. I took the picture used in this commentary on a trip…a testament that anybody can take breathtaking photos in the area because the subject matter is so stunning.

My piece today isn’t meant to be a travelogue, but a reminder that the Federal Reserve recently held their annual Jackson Hole confab. The Kansas City Fed has been the long-time host of this event, but this year the meeting was virtual— a sign of the times in which we live.

At times, this confab has been the launching pad for significant announcements by global central bankers. For example, in 2008, officials were grappling with the deepening financial crisis. In 2014, then European Central Bank Chair Mario Draghi laid the groundwork for a new bond-buying

program, intensifying the central banks’ zero interest rate policy (ZIRP) positions. Last year, Powell released the Fed’s new view of inflation.

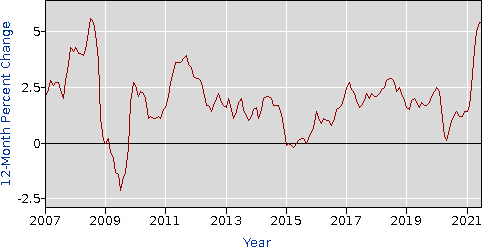

No longer targeting 2% inflation, at the last Jackson Hole gathering the Fed announced their tolerance of higher inflation pressure by accepting a range of 2% inflation, implying that a higher level of tolerance toward building inflation pressure. That announcement made it clear that of the two Fed mandates (full employment and stable prices), the Fed would favor policies designed to spur full employment, perhaps at the expense of higher inflation pressure. They have received what they wanted. Lower unemployment and higher inflation. Note the chart below, which is from the Bureau of Labor Statistics and shows the year-over-year change in the Consumer Price Index. By this measure, inflation is higher now than any time since 2008, just prior to the financial meltdown of 2008-2009, and the onset of the deepest recession witnessed since the Great Depression.

Many at the Fed and others are now focusing on inflation being a building problem. The Fed has repeatedly said that the upward push in inflation (at a 5%+ year over year rate) will prove transitory.

I have written on this issue in the past. I don’t share the casual view of this issue with the Fed, but believe a 5%+ inflation rate will prove unsustainable. Where I differ with some is the landing spot, the endgame, if you will, of inflation. If inflation rates are going to contract, where will they contract to?

The Fed obviously has been preaching their view that inflation will return to the 2% annual range. I believe the number and the inflationary pressures will prove to be higher than the Fed’s view. Why? Two issues, which were highlighted in a Wall Street Journal article, are proving sticky.

- Supply bottlenecks are broader and proving to be more sustainable than many had antici- pated. In a world of “just-in-time” inventory practices, when bottlenecks occur, one of two things happen—either rationing happens, or prices rise, or both. Additionally, when many of your manu- factured goods are being imported from one source—China—then interruptions in those supplies can prove damaging to pricing.

- Second, Congress and the White House have pumped federal aid to many in the U.S. at a rate in which the Fed and many hadn’t anticipated. This aid supercharged consumer demand at the same time that vaccination rates and business reopenings were taking off. The Wall Street Journal notes that in December 2020, the Trump administration authorized $900 billion in new aid. In March of this year, Congress approved Biden’s $1.9 trillion assistance package. Next up, Congress is at- tempting to pass $3.5 trillion in new spending to be spread over the next number of years.

Washington’s spending programs powered growth in final demand at both the consumer and business levels. Such is the way of Keynesian economics, in which the focus is directly upon growth in final demand. Growth in supply? Forget about it…that wasn’t aggressively addressed. When growth in demand far outstrips growth in supply, prices rise or outright rationing occurs. The laws of economics

can’t be violated because unintended consequences will occur if supply/demand imbalances are created.

Getting back to the original question, “What level will inflation reach?” The key that I have been focused on is labor pricing growth rates relative to productivity growth rates. That relationship can be a significant driver of cost-push inflation pressure, an inflation form that is much harder to manage over the longer term than our current demand-pull inflation variety.

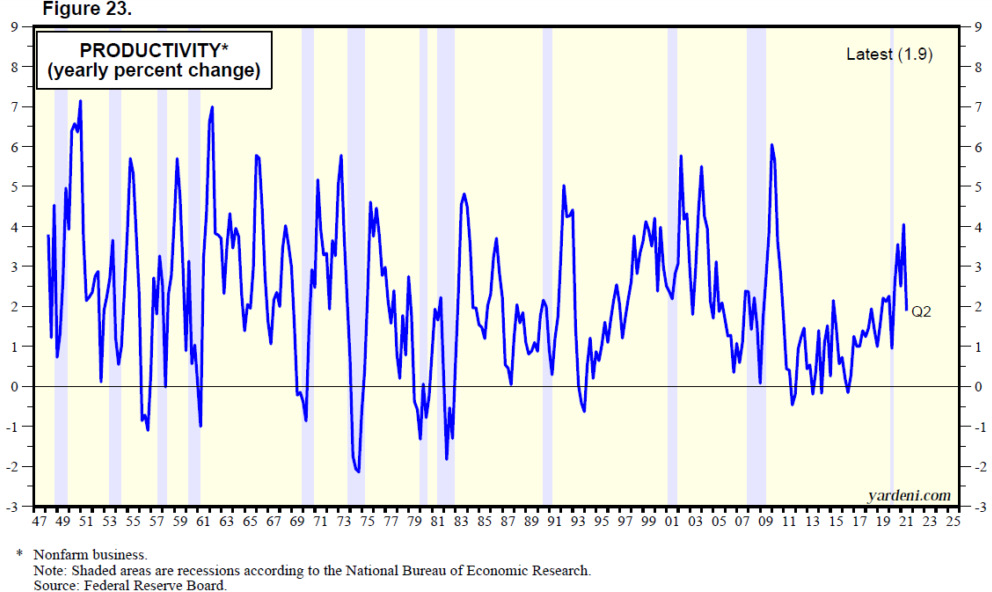

As noted, one key to avoiding a cost-push inflation spiral from occurring is for labor productivity growth rates to exceed labor total compensation growth. This only makes sense. If workers are very productive, businesses can raise their wages without the need to pass on these increased costs by raising prices. Note the previous chart, which shows the year-over-year change in labor productivity. The most recent data we have regarding this important variable is through the second quarter of this year. At that time, productivity had increased by 2% over the previous 12 months (See chart below.). To the extent that labor costs increase by more than that level and productivity growth doesn’t change, then the probability of experiencing a cost-push inflation cycle increases.

Source: Yardeni Research

Fed Expectations

So, what of the Fed? In his prepared speech at Jackson Hole, Jerome Powell, the Fed chairman, did lay out the expectation that the Fed may change their bond purchasing program by the end of this year, matching our expectations. But it seems many investors believe the Fed will walk the monetary tightrope of not being too early, nor too late, in possible upcoming changes in policy.

The ramifications of the timing of the Fed policy changes are meaningful. If the Fed tightens too quickly, the economy struggles as GDP growth will weaken and stock/bond prices take it on the chin. If they stick around and tighten too late (some think this is already happening), then the Fed policy fosters higher inflation pressure than would have otherwise been the case. If this is proven, stock and bond prices take it on the chin.

I think the Fed is viewing the upward surge in inflation as a manageable issue. Their main worry has been to provide an underwriting function for government fiscal spending, helping drive the improvement in the labor market. Through their actions, the Fed is now the largest purchaser of Treasuries, by far. The liquidity provided by this largesse gives market participants the comfort that

the Fed is behind the market and won’t let it sag. That rings true, until the gig is up, that is, if inflation proves to be more sustainable. If so, that cushion alters, and the Fed becomes less accommodative.

My Expectation

I suggest that inflation this year (fourth quarter to fourth quarter) will be +3.5%. So, the good news is that I expect annual inflation data to moderate by the end of the year from the current 5%+ range. The bad news is that 3.5% is well above the Fed’s inflation range of 2%. I expect to see further inflation moderation occur in 2022, down to the 2.5% level.

Along with moderation in inflation rates, GDP growth rates should also moderate in 2022 as compared to the red-hot growth we are experiencing this year. I expect 2.5% inflation and 2.5% real GDP growth in 2022, totaling 5% nominal GDP growth. That combination should be enough for the Fed not to get carried away and tighten monetary policy aggressively.

That being said, I sense inflation may be more of an issue over the next five years than has been the case over the last decade. Since the first of the year, I have been forecasting that the Fed will start to taper their bond-buying program before the end of this year, to be followed by their first increase in short- term rates sometime in 2022. So far, the Fed is going along with our playbook. If this continues, we suggest monetary policy should become more normal by the end of next year, and the attendant capital market price distortions that have been part of our landscape for some time, may start to moderate.

In the meantime, the Fed has the market’s back. That is, until they don’t.

This commentary is limited to the dissemination of general information pertaining to Mariner Platform Solutions’ investment advisory services and general economic market conditions. The views expressed are for commentary purposes only and do not take into account any individual personal, financial, or tax considerations. As such, the information contained herein is not intended to be personal legal, investment or tax advice or a solicitation to buy or sell any security or engage in a particular investment strategy. Nothing herein should be relied upon as such, and there is no guarantee that any claims made will come to pass. Any opinions and forecasts contained herein are based on information and sources of information deemed to be reliable, but Mariner Platform Solutions does not warrant the accuracy of the information that this opinion and forecast is based upon. You should note that the materials are provided “as is” without any express or implied warranties. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Past performance does not guarantee future results. Consult your financial professional before making any investment decision.

Investment advisory services provided through Mariner Platform Solutions, LLC (“MPS”). MPS is an investment adviser registered with the SEC, headquartered in Overland Park, Kansas. Registration of an investment advisor does not imply a certain level of skill or training. MPS is in compliance with the current notice filing requirements imposed upon registered investment advisers by those states in which MPS transacts business and maintains clients. MPS is either notice filed or qualifies for an exemption or exclusion from notice filing requirements in those states. Any subsequent, direct communication by MPS with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For additional information about MPS, including fees and services, please contact MPS or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you invest or send money.

Investment Adviser Representatives (“IARs”) are independent contractors of MPS and generally maintain or affiliate with a separate business entity through which they market their services. The separate business entity is not owned, controlled by or affiliated with MPS and is not registered with the SEC. Please refer to the disclosure statement of MPS for additional information.